Market picture

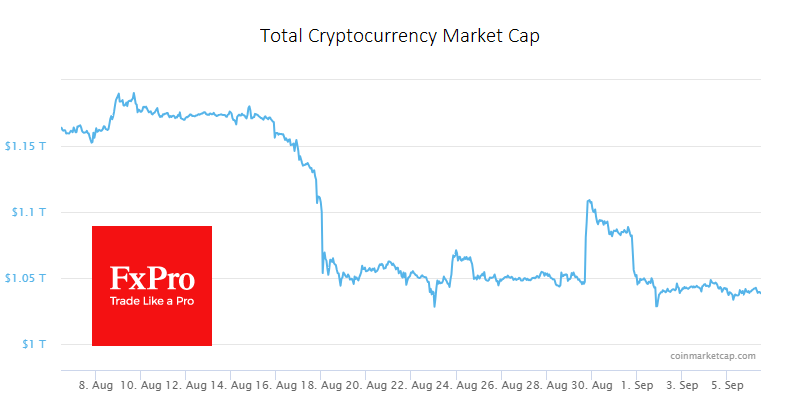

Crypto is out of volatility mode, moving in a narrow range of around $1.04 trillion over the last 24 hours, with little change in the total cap. This could be another pause before a new step down the ladder, as we have seen since July, or a preparation for further growth. We are now leaning towards the first option.

Bitcoin has stabilised around $25.7K, lower than it was at the end of last week. This dip looks like speculators trying to find demand to push the price higher. However, we believe that buyers will remain on the sidelines until the $25K level is reached. This has been the critical level for the last 14 months, and we do not expect a real bull-bear battle until this level is reached.

On the monthly timeframe, Bitcoin confirmed an overbought stochastic exit in August, which could be a sign of disappointment for the bulls, notes Fairlead Strategies. The signal generated often indicates the passing of a local top, as happened in late 2017 and early 2021.

News background

User activity on crypto exchanges is at its lowest since late 2022, according to CCData estimates. It said that the number of Bitcoin transactions on centralised exchanges has fallen by more than 60% since October last year.

Since 2022, lawyers, consultants and other professionals have made more than $700 million from the bankruptcy of five major crypto companies, including FTX, The New York Times calculated by analysing court records.

Payments giant Visa will launch payments in stablecoins based on the Solana blockchain. The company will start testing USDC on the Ethereum network in 2021. The choice of Solana is due to faster and cheaper transactions compared to the ETH blockchain.

Centralisation of nodes is one of Ethereum’s fundamental problems, but an ideal solution may only emerge in 10-20 years, said Vitalik Buterin, the platform’s co-founder. He says the answer lies in making nodes cheaper and easier to maintain.

The FxPro Analyst Team