Market picture

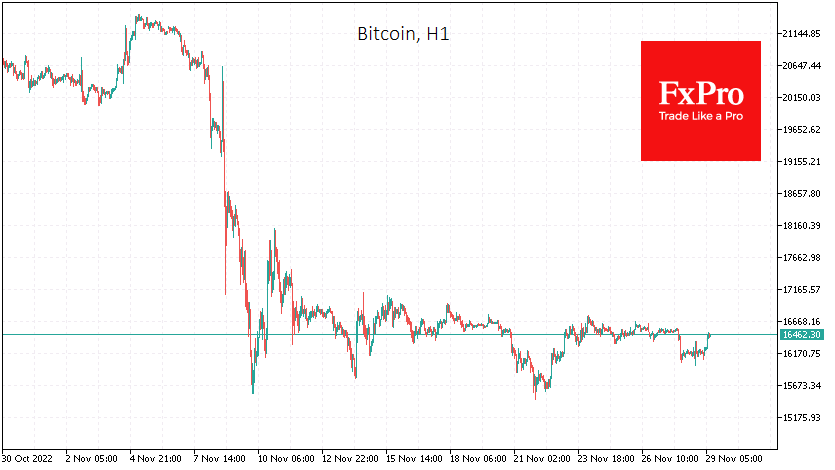

Bitcoin declined on Monday along with stock indices, testing six-day lows near $16K, following a decline in demand for risky assets due to unrest in China. Near this round level, the first cryptocurrency saw a demand, and in early trading on Tuesday, cryptocurrencies rose more actively than traditional markets, bringing the price of Bitcoin back to $16.5K.

According to CoinMarketCap, total capitalisation rose 2.2% overnight to $835bn, while the top coins add between 2% (Cardano) and 9% (Dogecoin), and Ethereum is again hovering around $1200.

The cryptocurrency market is showing signs of buying on the downturn and has been performing better than stocks for the past 24 hours, bolstering buyers’ hopes.

Major players continue to go bust, adding the BlockFi platform to the list, and Hong Kong exchange AAX is having problems. The market seems to be taking this news as part of the sector’s recovery process, with weaker projects leaving.

News background

Santiment notes that wallets with large balances (100-10,000 BTC), after three weeks of net sales of 1.36% of total volume, have accumulated 0.24% in the last five days. It looks like the whales may be about to stop selling.

Meanwhile, Glassnode claims smaller players are increasingly buying bitcoin on the dips. Investors with less than 1 BTC balance have added 96,200 BTC to their total holdings since the FTX crash.

According to CoinShares, investments in crypto funds fell by $23 million last week, with the outflow of funds the highest in 11 weeks. Bitcoin investments decreased by $10m, and Ethereum by $6m. Investments in funds allowing shorts on bitcoin increased by $9m. Negative market sentiment persists after the FTX collapse, CoinShares noted.

Regulators could take years to catch up and successfully control the cryptocurrency industry, so the industry needs to learn how to do it independently, says billionaire Bill Eckman.

The FxPro Analyst Team