Market picture

Total cryptocurrency capitalisation fell 1.2% to $1.08 trillion as pessimism returned to global markets. However, Bitcoin’s second-day moves are centred around $28.3K. This is above the 200-day and 200-week moving averages, suggesting a it is still in a bull trend.

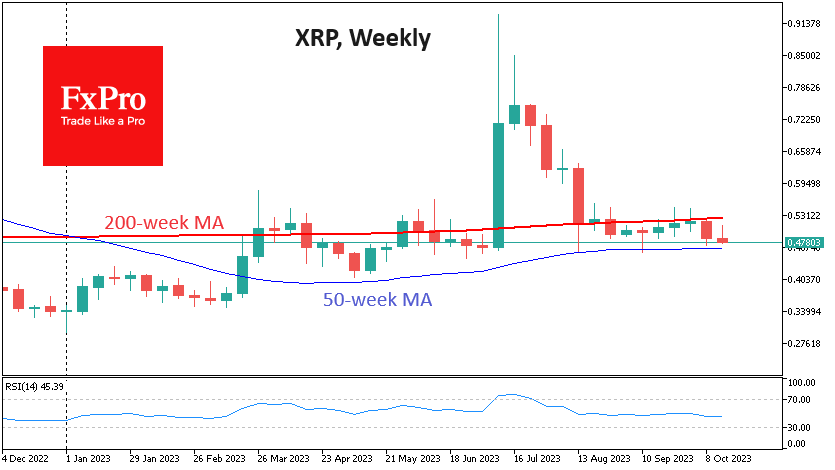

However, we are concerned about the first cryptocurrency’s inability to break away from its major trend indicators. Even more worrying is the dynamics of the altcoins. XRP is losing for the third day and has been trading around lows since July. It is falling below its 200-week MA, and there is only a faint hope of a reversal from the 50-week MA, now at 0.4650.

Ethereum has erased gains made earlier in the week and is heading towards the lower boundary of the descending channel – now at $1515.

The exception is Solana, which is trading near this week’s highs. It managed to break above its 200-day MA a week ago. Furthermore, a bullish “golden cross” signal is forming as the upward-sloping 50-day MA prepares to cross the 200-day average before the end of the month.

News Background

According to Bitfinex, long-term investors now hold 80.34% of the total supply of bitcoin. The hoarding trend has been accelerating since late 2022, and the exchange supply of BTC has been shrinking since around the same time.

Considering previous comments, investment giant Fidelity has filed an updated application with the SEC to launch a Bitcoin spot ETF. The updated filing offers increased transparency, liquidity, and security.

The former head of the Commodity Futures Trading Commission (CFTC), Heath Tarbert, urged authorities to speed up the development of stablecoin regulation to strengthen the US dollar. He said that stablecoins could modernise the US financial system and make payments more efficient.

EU agrees to rules for sharing cryptocurrency tax data. Crypto firms in the EU must report customer assets for sharing with tax authorities.

According to Chainalysis, the UK has become the largest crypto economy in Europe, second only to the US and India globally.

The Fed is questioning the feasibility of developing and launching a digital dollar as the government-issued stablecoin could lose out to existing alternatives, particularly the FedNow instant payment system, said Michelle Bowman, a Fed’s Board of Governors member.

Online gaming platform Roblox denied reports that it would support payments in Ripple’s XRP token for in-game items. The project team called the information “inaccurate”.

The FxPro Analyst Team