Market picture

Crypto market capitalisation was climbing to $1.67 trillion on Friday morning – a new high since May 2022. However, very quickly, the market was hit by another wave of profit-taking, which has become commonplace over the past fortnight.

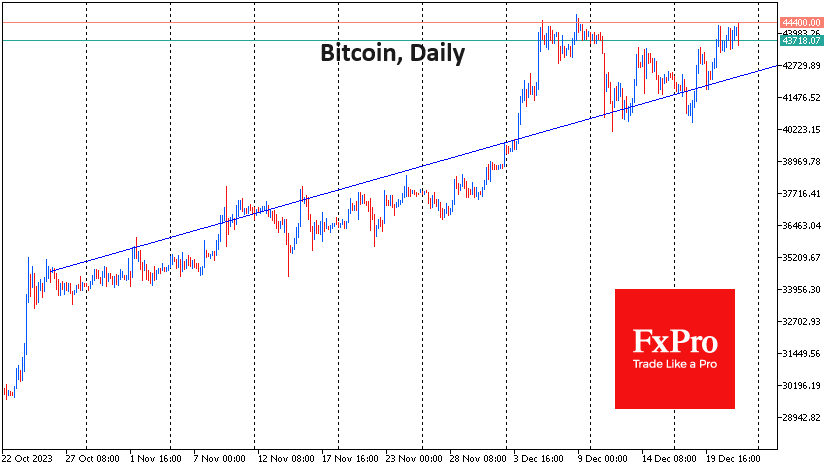

Bitcoin is once again pulling back down after touching the $44.4K level, having retreated to $43.7K by the start of active trading in Europe. Horizontal resistance has been effectively holding back the bulls for the past three weeks. On the other hand, the price dips are getting shallower, keeping the longer-term bullish trend in place.

Solana lost over 6% in a couple of hours, correcting after a failed assault on the $100 mark. But even with the pullback to $94, this altcoin is adding 8% in 24 hours and over 70% in 30 days. Its capitalisation is now only 8% below BNB, which is ranked #4 on CoinMarketCap.

The temporary nature of the BTC and SOL pullback is indirectly indicated by the positive dynamics of ETH, whose growth has accelerated in the last few hours and brought the price to $2300.

News background

A number of catalysts in conjunction with historical patterns could “catapult” Bitcoin to $160K in a bull market in 2024, according to CryptoQuant. In the short term, demand for BTC from several spot ETFs in the US, the upcoming halving and gains in stock markets following the US interest rate cut could lift the asset’s price to at least $54K.

According to CryptoQuant, bitcoin miners reached record total commissions amid increased trading activity in the Bitcoin Ordinals protocol due to increased demand for the blockchain space. The overall increase in transaction fees also impacted mining revenue.

Hardware wallet maker Trezor added support for Solana cryptocurrency (SOL) and SPL tokens. The new options come in the Model T and Safe three devices priced at $179 and $79, respectively. SPL is a Solana blockchain-based token standard similar to ERC-20 for Ethereum.

According to Messari, the average daily number of active addresses on the Solana network increased by 400% in the fourth quarter of 2023. During the same period, the number of Ethereum addresses participating in daily transactions grew by just 3%.

An appeals court in the US has formalised the seizure of 69,370 BTC belonging to the shuttered darknet marketplace Silk Road. The US Department of Justice seized the assets in November 2020.

In 2023, 42 countries around the world have implemented initiatives to regulate digital assets, according to a report by auditing firm PricewaterhouseCoopers (PwC).

The FxPro Analyst Team