Market Picture

The cryptocurrency market rose 1% in 24 hours to $2.28 trillion. The market cooled off somewhat during the day, moving away from local highs above $2.30 trillion, which were the highest in more than two weeks. Sentiment jumped sharply to ‘greed’, reaching the 65 level, the highest since late July.

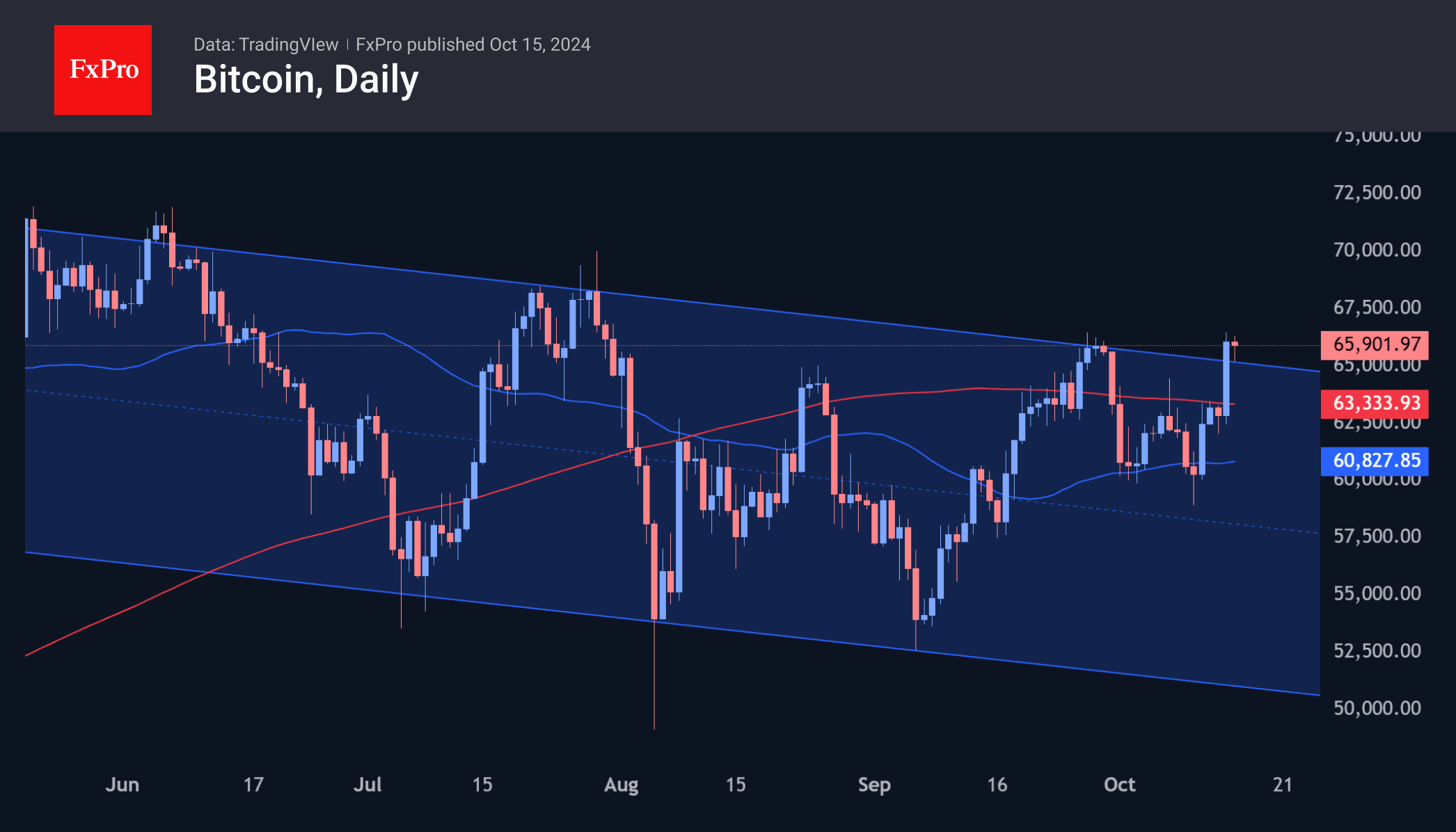

The price of Bitcoin traded above $66.5K for a while on Tuesday, matching the high of 30 July. This is a very nominal break above the previous high and an attempt to consolidate above the resistance of the descending channel. An important driver is the continued optimism in the US equity markets. Barring any sudden bouts of profit-taking, Bitcoin could consolidate the breakout from the multi-month downtrend. The potential first target of the new bull rally looks to be the area of historical highs as it approaches $74K, with a more distant target of $80K by the end of the year.

News Background

According to CoinShares, global crypto fund investments increased by $407 million last week, following outflows of $147 million the week before. Bitcoin investments increased by $419 million, Solana investments increased by $0.6 million, and Ethereum investments decreased by $10 million.

According to experts, BTC’s growth is being fuelled by expectations of new stimulus measures in China. Over the weekend, Chinese Finance Minister Lan Fo’an said that the country will soon introduce a package of additional fiscal measures to support economic development.

Searches for Bitcoin on Google fell to an annual low. Searches for altcoins show a similar dynamic. At the same time, user interest in meme coins remains relatively stable. The segment is recovering despite the massive failure of new coins and the disappointment of some traders.

The UAE Central Bank has approved the launch of a dirham-based stablecoin, the AED stablecoin. This coin is leading the race to become the first issuer of a regulated stablecoin.

The FxPro Analyst Team