Market Picture

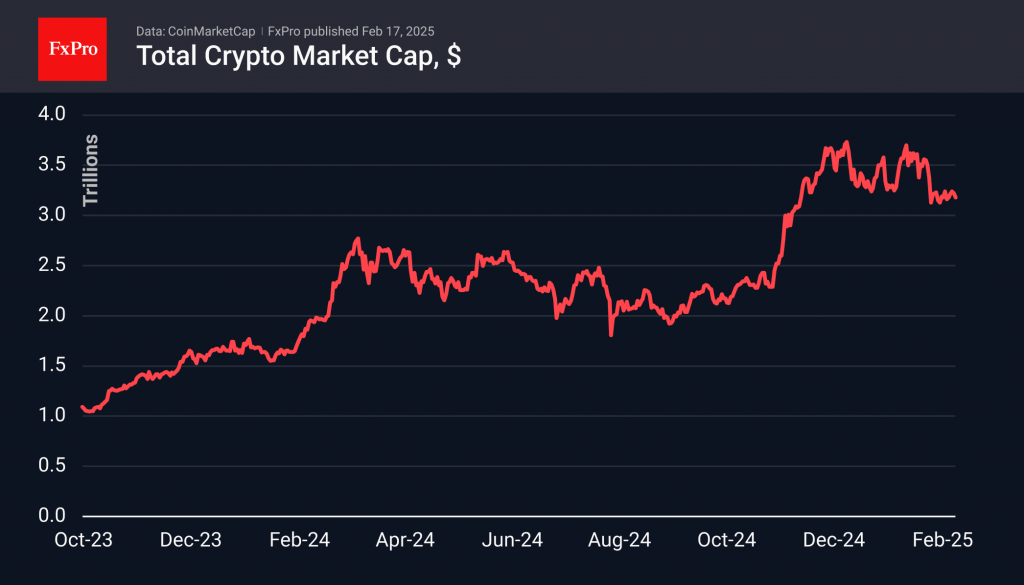

The crypto market has been sluggishly declining since the end of last week, pulling back 0.8% in the last 24 hours to $3.19 trillion. This is marginally higher than levels a week earlier, but we see the market stabilising at a lower level compared to January. The $3.3 trillion capitalisation level is acting as resistance where sellers are taking the initiative.

Trading volumes have pulled back to levels we saw prior to last November as the sentiment index drops from greed to the borderline territory between fear and neutral.

Bitcoin has been moving almost strictly horizontally since the 5th of February, hovering near $95,000 for most of the time. This is below the 50-day moving average, breaking the upward trend. The lack of a sell-off, however, suggests there is still interest in long-term buying on dips near current levels.

Solana pulled back to $180 on Monday morning, attempting to dip below the 200-day moving average. The coin reversed to gains near these levels in December and January. A sustainable move lower would be the second bearish signal for the broader crypto market, following a similar decline in Ethereum in early February.

News Background

The positive weekly trend in US spot bitcoin ETFs broke after six weeks of inflows. According to data from SoSoValue, net outflows from spot bitcoin-ETFs in the US totalled $581.2 million for the week, cumulatively totalling $40.12 billion. Net outflows from ETH-ETFs totalled a small $26.3 million, bringing cumulative all-time inflows to $3.15 billion.

Santiment calculated that the BTC had shed 277,240 active wallets over the past few weeks, which they attribute to fears of further price declines.

Abu Dhabi Sovereign Wealth Management disclosed a $436.9 million investment in BlackRock’s spot bitcoin-ETF (IBIT). Barclays Bank also disclosed a $131.2 million investment in IBIT. The largest institutional investor in IBIT, Goldman Sachs, has invested more than $1.6 billion in IBIT.

Cryptocurrency trading volume on crypto exchange Coinbase grew 137% in the fourth quarter of last year, while online broker Robinhood saw a 393% increase. The drivers were the hope for more sector-friendly regulation after Donald Trump’s victory.

Users of the Wallet custodial mini-app Wallet on Telegram have been given the option to buy Tether’s USDT stablecoin with zero fees. The option was implemented with the support of the Mercuryo payment network and in cooperation with The Open Platform infrastructure platform for developers in the TON ecosystem.

The FxPro Analyst Team