Market picture

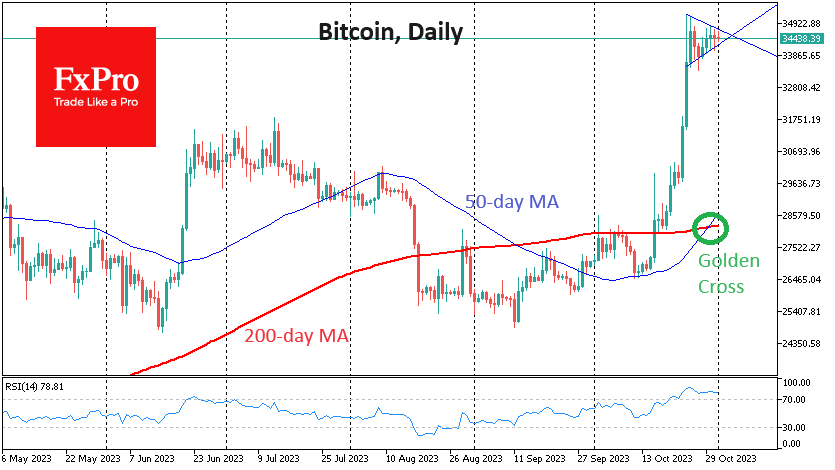

October was the second best-performance month for Bitcoin this year after January. BTC soared 27% to highs over the past year and a half above $34K.

Regarding seasonality, November is considered a moderately successful month for BTC. Over the past 12 years, Bitcoin has ended the month on seven occasions with an average gain of 24%. In cases of decline, the average drop was 17%.

The “Golden Cross” on Bitcoin’s daily timeframes was formed at the end of October thanks to the price rally in the second half of the month. But this event did not trigger further buying. The same was true with the “Death Cross” in September, which came the day after the local price bottom.

After crossing the $34K mark, the early phase of the bull market began, according to Look Into Bitcoin. Pointsville founder Gabor Gurbach cited the increased presence of institutionalisation as the main driver of further growth.

News background

Trader Rekt Capital is not so optimistic. After halving, he expects consolidation in the range of $24K-$30K and only later an exit on the parabolic growth to the six-digit marks.

Billionaire Stanley Drakenmiller called Bitcoin “gold for the young.” He said that while he regrets not owning BTC, he prefers investing in gold.

It is the 15th anniversary of the Bitcoin white paper. On 31 October 2008, a person (or group of people) under Satoshi Nakamoto’s pseudonym published the Bitcoin white paper. The nine-page technical document described the principle of operation of the peer-to-peer payment system, which later revolutionised the world of financial technology.

Crypto exchange Bittrex has received court approval for a revised bankruptcy plan and winding down operations in the US. Bittrex Global continues to operate outside of the US.

Attackers hacked a popular Telegram bot to track transactions on the decentralised exchange Uniswap. Against this background, the price of the native token UNIBOT fell by more than 40%.

The FxPro Analyst Team