Market picture

The crypto market lost 1.4% overnight to $1.19 trillion. Bitcoin, down 1.6% at $28K, once again underperformed the market. Ethereum fell just over 1% to $1890. This Bitcoin dynamic can be attributed to its outperformance in the March episode of capital flight from banks. That money is now neatly parked elsewhere while Bitcoin is “resting”.

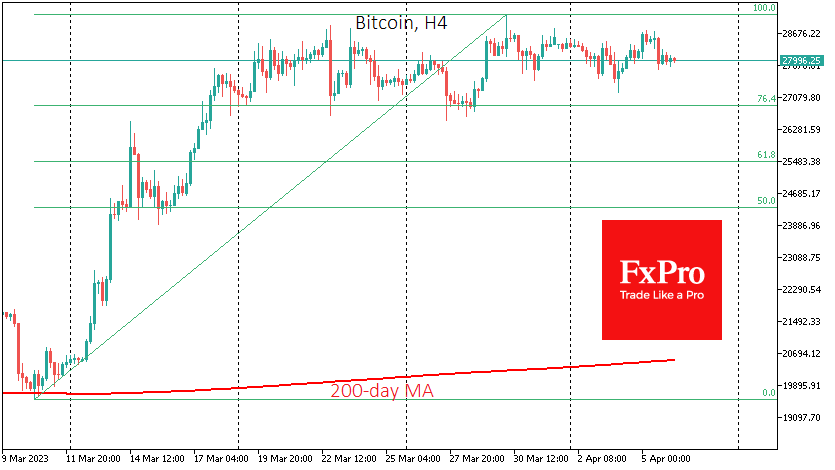

Bitcoin’s recent pullback has confirmed that the trading range of the past two weeks remains in place. The first cryptocurrency does not see any significant obstacles on the way down to levels near $27K. The deepening drawdown could be influenced by negative sentiment in traditional financial markets.

MicroStrategy additionally bought 1,045 bitcoins for approximately $29.3 million at an average price of $28,016 per BTC, according to company founder Michael Saylor. MicroStrategy now owns 140,000 BTCs worth $4.17 billion at an average price of $29,803.

According to Kaiko, the correlation index between bitcoin and gold has reached 50%. Meanwhile, BTC’s dependence on the US stock market has fallen to 20%.

News background

The total capitalisation of gold-linked tokens has exceeded $1 billion. There are two major players in the market, PAX Gold, and Tether Gold, which account for 99% of gold tokenisation.

According to Lookonchain, the crypto whales, who control more than 10,000 ETH, are preparing to sell and have already started adding to exchange wallets. A coin reset is likely to take place when the altcoin exceeds $2,000.

Swiss state-owned bank PostFinance, the fifth largest by assets, has announced that it will offer a “full range of cryptocurrency services” to its 2.5 million customers.

According to Morning Consult, a majority of Latin American adults, unlike Americans, believe cryptocurrencies will become legal tender.

The FxPro Analyst Team