Market picture

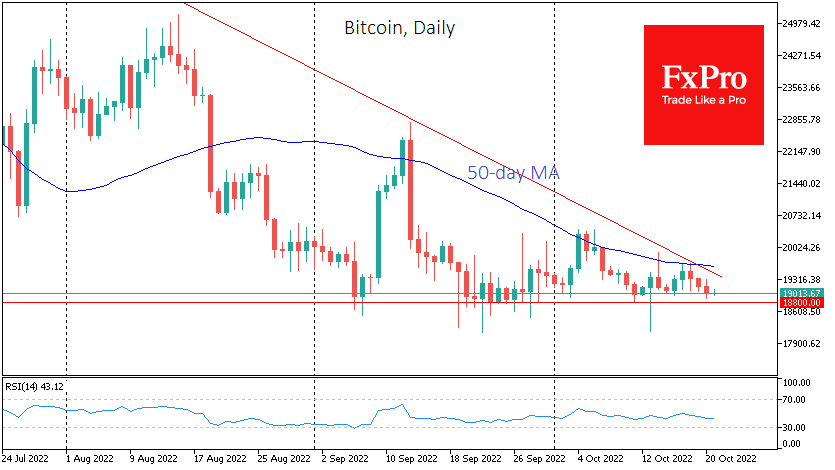

Bitcoin is trading near $19K on Friday morning, losing 0.5% overnight. It hovered between $18.9K and $19.3K on Thursday, remaining pinned closer to the lower end of its trading range due to pressure in the US equity market and gold at the close of trading in New York.

Bitcoin has closed lower for three consecutive days, but the bears have not yet decided to storm the support of the last four months. So far, we have seen an inertial retreat of cryptocurrencies amid a melting demand for risky assets (gold and equities) due to rising US interest rates.

Cryptocurrencies have been selling bitcoin for the past few months, reducing their reserves to a three-year low, according to a Santiment report. It was only last week that the whales changed tactics and began returning to cold-storing BTC.

Hashrate Index notes that public miners sold fewer bitcoins than they mined for the first time since May, in August and September. The market continued to pressure miners’ financial strength throughout the third quarter.

News background

Bitcoin will grow by 400% and reach $100,000 next year even before another halving, said renowned crypto trader and blogger Ton Weiss. According to him, the halving will be implemented earlier than investors expect, closer to March or April 2024. But the hype of the upcoming event will manifest itself much earlier.

The cryptocurrency division of investment giant Fidelity Investments will offer institutional clients the option of trading Ethereum as early as the end of October. Bitcoin trading there was launched back in 2019.

According to a poll, more than 77% of Salvadorans opposed the purchase of bitcoins by the state, calling the government’s decision unfortunate. El Salvador declared BTC legal tender in September last year.

The FxPro Analyst Team