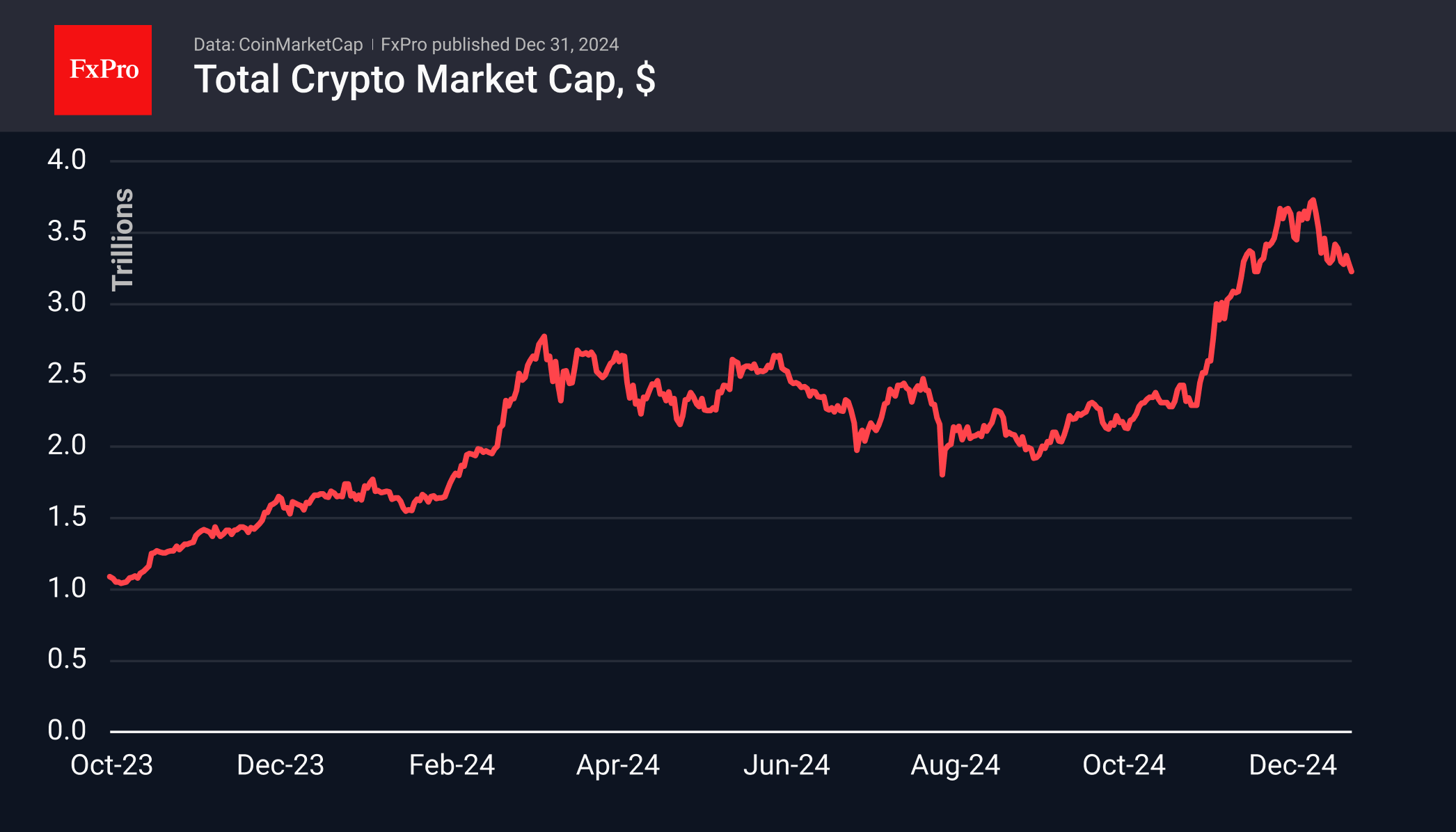

The cryptocurrency market continues to fall, losing some of its significant growth since the beginning of the year. Its capitalisation fell a further 1.4% to $3.23 trillion, matching the lows of the last week and a half. An attempt to stabilise on Monday failed amid a cautious mood in equity markets. It is too early to talk of a complete victory for the bears; rather, the bulls have not yet received any fresh impetus for buying from external factors.

The market ends December down, with only three of the top 10 coins showing growth: BNB, XRP and TRON.

XRP has gained 6.8% in the last 30 days after losing over 20% in the last 27 days. This is the remnant of November’s strong momentum. Like Bitcoin before it, XRP has now pulled back to the 61.8% level of the initial rally. The chances of buyers returning or accelerating the decline are roughly equal.

Similarly, TRON is up 23.6%, the remnants of the 2-4 December rally. While both coins looked overbought and in need of a cooling-off period in early December, that period has clearly dragged on, and the decline looks too deep to ignore.

Technically, XRP and TRON are trading above their 50-day moving averages. But it is important to note that bitcoin, the market’s flagship, has already broken below its respective line, a strong signal of a broken uptrend.

BNB is an important exception. Although it has retreated from its early December highs, it is trading solidly in the middle of the bullish corridor formed in September. It found support on a dip below its 50-day moving average before Christmas.

The FxPro Analyst Team