Brent is hovering around $100, a psychologically crucial round level. However, it would be a mistake to call it a lull. In our view, the current equilibrium could break at any moment, as geopolitics is now working for the bulls, while the economy, monetary policy, and technical market analysis are on the bears’ side.

Oil is performing better than the market, thanks to unexpected comments from Saudi Arabia about its willingness to cut production when the world is suffering from energy shortages.

This was a clear signal that OPEC continues to target historically high oil prices, preferring not to fight for market share as it did in 2014. Back then, however, Saudi Arabia had to compete for the market with the rapidly gaining US and Russian production. The latter has now moved into the lame duck category, where a 5-15% drop in output over the next 12 months would be excellent news.

The United States is clearly failing to seize the initiative and start aggressively ramping up its production. According to figures published on Friday evening from Baker Hughes, the number of working rigs rose by three last week to 765, of which 605 (+4 for the week) produce oil. However, we saw a much higher production growth rate in 2009 and 2016, even though the world was by no means suffering from an energy crisis at the time.

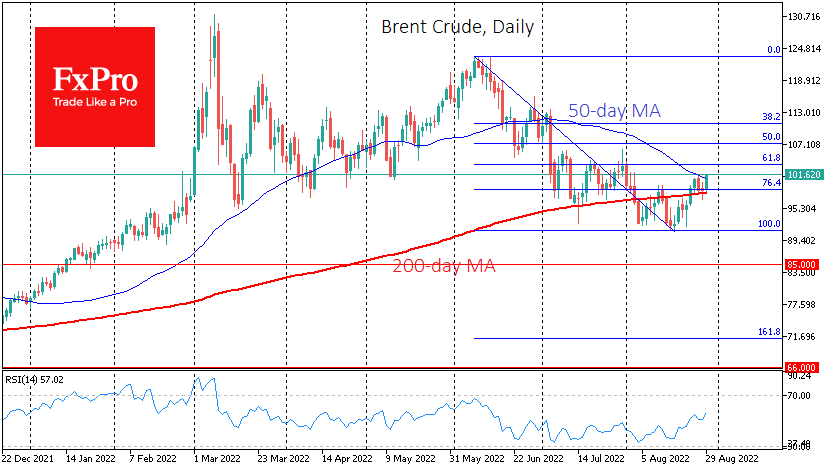

At the same time, the technical picture does not yet allow for a recovery of the bullish rally. WTI fell under the 200 SMA at the beginning of August, and despite the bullish comments of OPEC, it did not manage to go back above that level.

The price managed to bounce back from the August lows to levels of 76.4% from the June lows, which fits into the traditional retracement pattern.

The oil market is now focused on the upcoming OPEC meeting on September 5, where the cartel will discuss production quotas after September. CME’s OPEC+ Watch Tool indicates that markets are laying down an 18.7% chance of production cuts, creating a potential selling overhang if these forecasts do not materialise.

In addition, we need to pay attention to the continuing deterioration in GDP growth forecasts for the global economy and Europe’s drive to save energy. Over the medium to long term, economics invariably emerges as the winner compared to geopolitics. And now, the situation is shaping up for where the fight reaches intensity, followed by a turning point. The next few days will likely determine the trend for many months.

The FxPro Analyst Team