Market picture

The crypto market cap fell 1% in 24 hours to $2.36 trillion, in line with the US market’s losses during that time. The pullback in traditional finances explains why Bitcoin is dragging the overall crypto market down. Bitcoin is losing 1.3%, Ethereum 0.5%, and the top altcoins are changing between -4.7% (XRP) and 2.8% (Solana).

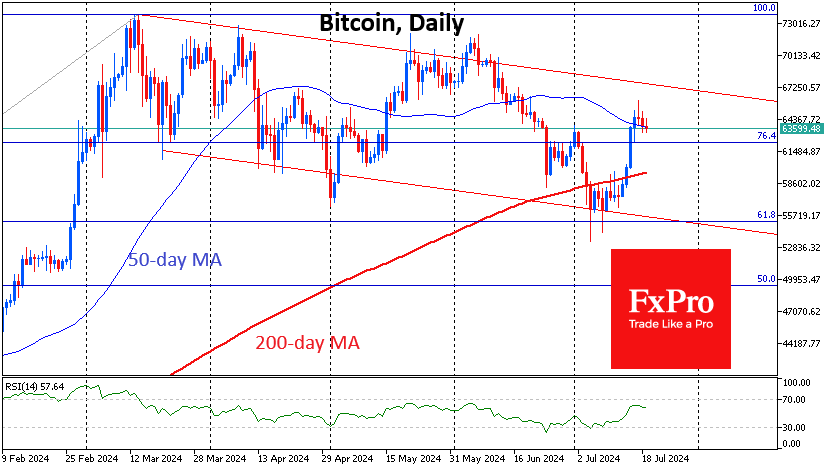

Bitcoin continues to tread around $64K, clinging to the area above its 50-day moving average. Consolidation after the rally in Bitcoin continues, with it technically far from overbought and sentiment far from euphoric, leaving room for gains.

Despite the unsightly external background, Solana set a new local peak at $164, the highest in six weeks. The coin withstood repeated attempts to sell the price below the 200-day average since the end of June. This support coincided with a 61.8% retracement of the rally from September to the March peak. The expansion pattern will activate if the price rises above $200, making the $320 area a potential target. It will take impressive FOMO and a successful Solana project effort to get the price there in the coming year.

News background

According to SoSoValue, spot bitcoin ETFs saw inflows of $53.35 million on 17 July. The positive trend continued for the ninth consecutive day with total inflows of $1.97 billion. In total, since the approval of BTC-ETFs in January, inflows have totalled $16.59 billion.

Billionaire investor Mark Cuban said Bitcoin could become a global safe haven amid geopolitical uncertainty and the dollar’s failure as a reserve currency. This would increase global demand for the first cryptocurrency as a means of saving.

Ripple executives expect the US SEC to drop further investigations and withdraw claims against the company after a series of unsuccessful lawsuits.

The SEC has approved applications to launch an Ethereum-based mini-ETF from Grayscale and an exchange-traded fund from ProShares. It is expected that trading in the instruments could begin on 23 July. The products do not involve staking, but this could change in the future.

According to CoinGecko, meme tokens were the most popular narrative in the cryptocurrency ecosystem at the end of Q2, with a 14.34% share. This was followed by real-world tokenised assets (RWAs) with 11.3% and artificial intelligence tokens with 10.09%. CoinGecko noted Ethereum inflation – the market supply of ETH for April-June increased by 120,000 coins.

The FxPro Analyst Team