Market Picture

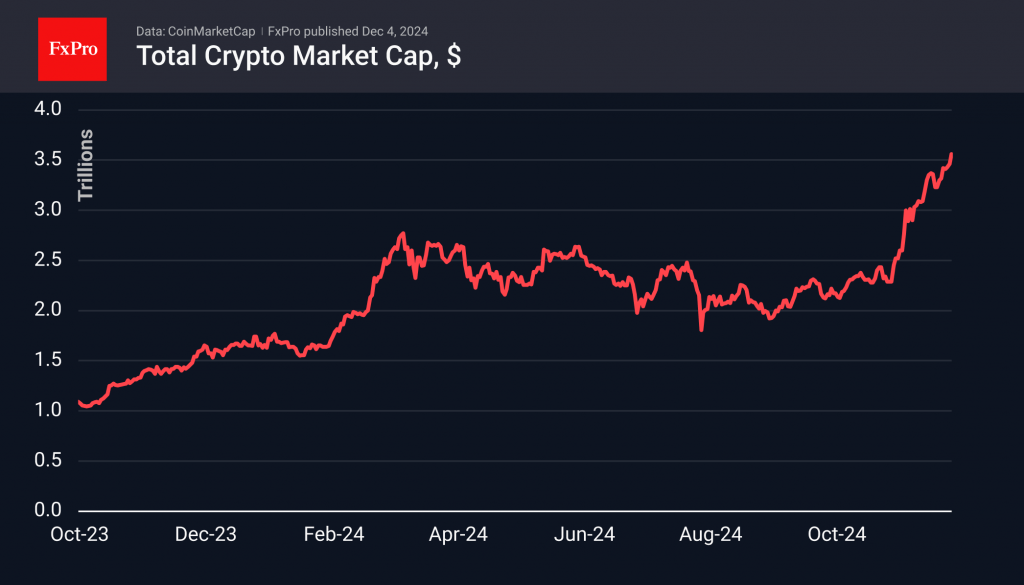

The crypto market has grown by 2.6% in the last 24 hours, reaching a new record of $3.56 trillion. Altcoins are still driving the growth, but this time, the momentum comes from different players. Among the top performers over the past day were Tron (+67%) and BNB (+18%). The Altcoin Season Index reached 89 amid a near doubling of altcoin capitalisation over the past month, four times faster than Bitcoin’s gains.

The first cryptocurrency is up 1.4% in 24 hours, hovering just below $97,000. On Tuesday, events in South Korea caused a brief dip to $93K, which attracted additional buying. Bitcoin’s rise seems like a logical trend amid political uncertainty in rich countries, including France and Germany. Technically, bitcoin remains in a consolidation mode as the price sits in the $92-100K range.

On Tuesday, Tron soared. A dramatic acceleration of growth occurred with the renewal of historical highs at $0.23. Liquidation of short positions brought the price closer to $0.45 before stabilising at $0.39. A continuation of the bull run makes $0.60 the next potential target.

News Background

Another recalculation showed that the first cryptocurrency’s mining difficulty increased by 1.59%, reaching a high of 103.9 T. The average hash rate for the period since the last value change was 832.7 EH/s.

BTC growth will be volatile due to the profit taken by holders and BTC ETF dynamics. At the end of last week, clients withdrew $457 million from Bitcoin funds, while long-term investors reduced their balances by 508,990 BTC.

According to Bitfinex, the number of coins held by speculators approached a cyclical high of 3,282,000 BTC. The number of coins held by long-term investors fell to 12.45 million BTC, the lowest since July 2022, IntoTheBlock calculated.

Arkham Intelligence noted that US authorities sent 10,000 BTC (~$963 million) related to Silk Road to Coinbase. QCP Capital attributes the current bitcoin correction to these reports.

The FxPro Analyst Team