Moody’s US credit rating downgrade spooked Bitcoin, but not for long. According to HSBC, the recent trade truce between Washington and Beijing changed the game. It has permanently raised global risk appetite, allowing digital assets to flourish. Could the loss of the States’ latest top rating stop the BTCUSD bulls? As it turns out, no.

Bitcoin is being driven upwards by a crowd of retail investors, who are also driving the US stock market. Small players don’t care that the US economy is slowing down, and the Fed is not going to cut rates. Traders are buying the S&P 500 and digital assets simply because they are rising. At the same time, Morgan Stanley’s recommendation to buy the dips in stock indices is adding fuel to the fire of the rally in stocks and BTC.

Traders are not particularly concerned about the fact that as Bitcoin grows, the number of fraudulent transactions increases. For example, criminals fraudulently gained access to Coinbase’s customer base and demanded a ransom of $20M for silence. Binance and Kraken also fell victim to the attack but managed to protect themselves. In February, Bybit was hacked, and $1.5B worth of cryptocurrency was stolen, the largest crypto theft in history.

Meanwhile, Donald Trump continues to popularise digital assets by announcing a dinner party for holders of the TRUMP coin. Its value skyrocketed in the first few days of circulation but has since drastically fallen. White House representatives do not see any conflict of interest in the fact that the US president makes money in the industry that he promotes.

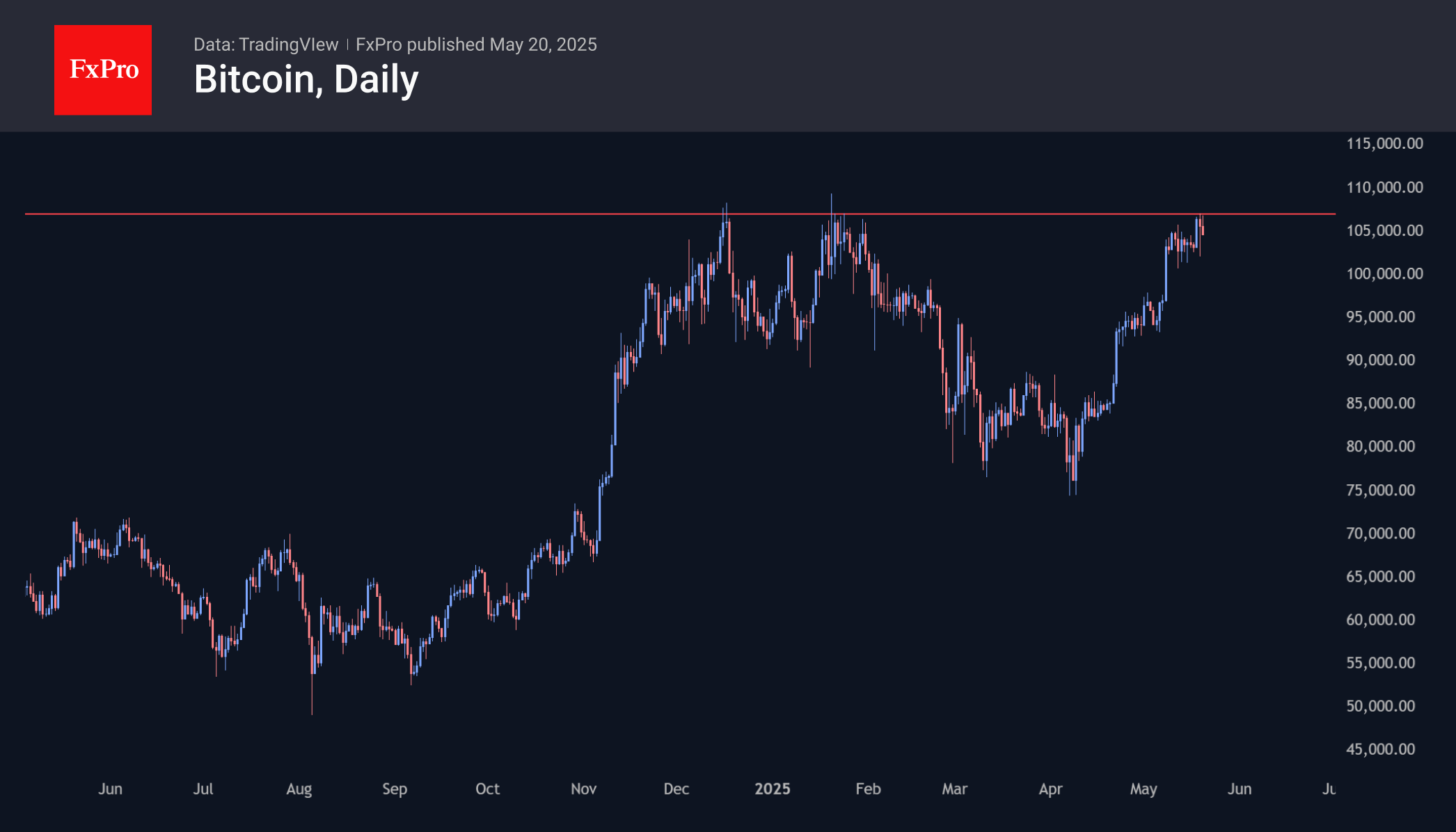

Further dynamics of BTCUSD will depend on changes in global risk appetite. As the downgrade of the US credit rating showed, fans of risky assets in general and Bitcoin in particular are hard to scare. If the resistance at 107K is broken, there are more chances to restore the uptrend.

The FxPro Analyst Team