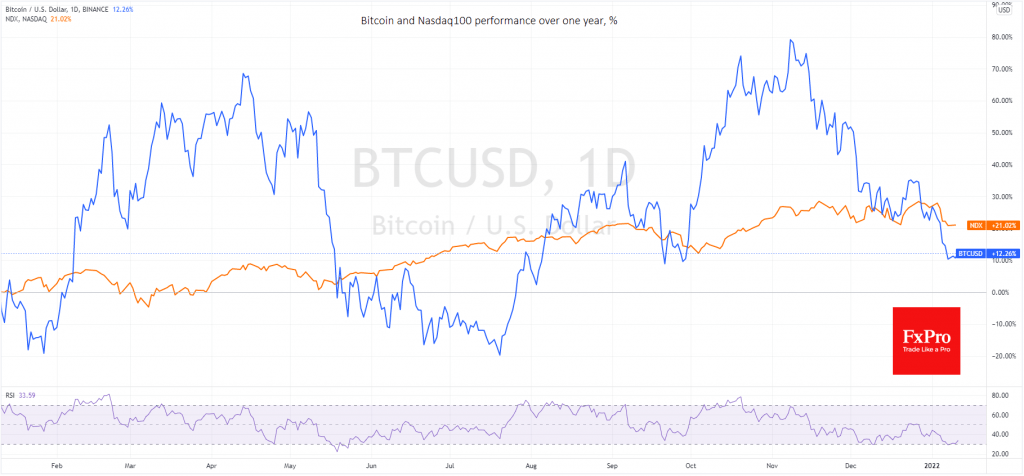

On Monday, we saw colourful confirmation of how much stock market dynamics are affecting Ether and Bitcoin. Following the intraday fall of more than 2% in the Nasdaq, the top two cryptocurrencies surrendered their psychologically important levels, retreating at $ 3K and $ 40K, respectively.

However, in all cases, the fall was redeemed. The Nasdaq closed with a nominal decline, and Bitcoin very quickly returned to levels near $ 42K. Ether is currently trading at 3100, gaining over 1% since the start of the day.

The broader technical picture has not changed, indicating locally oversold, which puts buyers on the run who have been waiting for a discount in recent days.

The crypto market has been losing 0.6% over the past 24 hours, but since the beginning of the day, it has been adding 1.6% to $ 1.96 trillion against the dip to $ 1.86 trillion at the peak of the decline on Monday evening.

The Cryptocurrency Fear and Greed Index lost 2 points in a day, dropping to 21. This is still in extreme fear, just like yesterday and a week ago.

In our opinion, bitcoin and ether are bought locally by enthusiasts and a number of long-term strategic investors, while investment funds trade them based on bursts of demand or risk aversion.

By and large, this puts cryptocurrencies on a par with growth stocks, sensitive to the dynamics of interest rates: the rise in profitability causes a sell-off of risks. At the same time, we must not forget that cryptocurrencies are more mobile, that is, they sometimes lose twice or three times more than Nasdaq. If so, then cryptocurrencies are far from the bottom since the process of normalizing interest rates in financial markets is far from complete.

The FxPro Analyst Team