Market picture

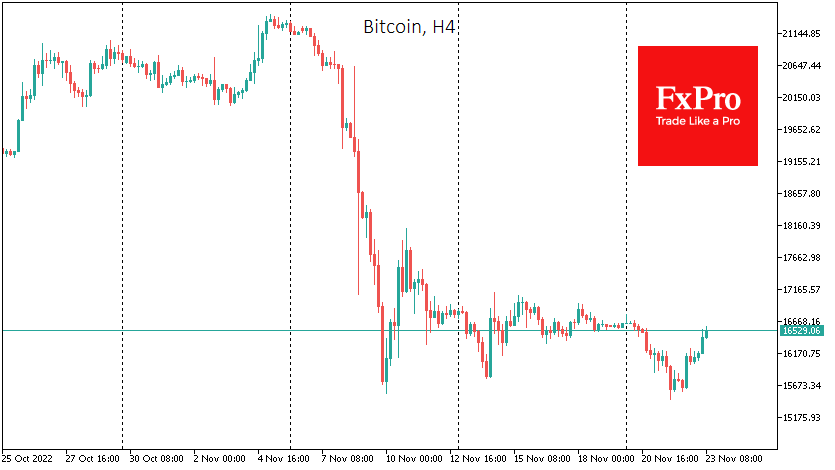

Bitcoin is adding 5.1% over the past 24 hours to $16.5K on Tuesday after updating two-year lows below $15,500. The rate rose in two powerful bursts, one at the start of trading in the US and the other at the beginning of trading in Asia. It’s unlikely we will see a start of a promising move on high volumes. So far, as a reflex, investors are trying to follow the stock indices, where risk appetite is increasing.

Ethereum is adding 6.7% in 24 hours as traders are encouraged by its ability to defend the $1,000 level. Top altcoins are adding from 4.6% (Cardano) to 30% (Litecoin) over the last 24h. The latter is rising on signals that the SEC may recognise the coin as a digital commodity, like Bitcoin, rather than an asset like almost all other cryptocurrencies.

Despite the rebound, Bitcoin is still below the level it started the week, so we characterise the current move as a rebound rather than the beginning of a recovery. Bitcoin first needs to consolidate above $17K as a first reversal signal. More chances are that we are still seeing another mini rally in the bear market.

News background

Binance will not invest in Genesis Trading amid the crypto lending platform’s search for $1bn in emergency funding, The Wall Street Journal reported. Without an additional cash infusion, Genesis Trading is potentially facing bankruptcy.

According to Glassnode, miners this year have sold the most significant volume of bitcoins since 2016. Capriole fund founder Charles Edwards noted that miner sales had soared 400% in the past three weeks. According to him, if BTC does not rise soon, we will see a massive bankruptcy of mining companies.

The crypto market has seen a noticeable drop in liquidity following the collapse of FTX, Kaiko noted. Trading volumes on crypto exchanges more than halved to $100bn every week.

The US House of Representatives Committee on Agriculture will hold a hearing on December 1 on the crypto-exchange FTX and measures to mitigate the impact of its collapse. The hearing is expected to feature remedial proposals from the head of the Commodity Futures Trading Commission (CFTC), Rostin Behnam.

The FxPro Analyst Team