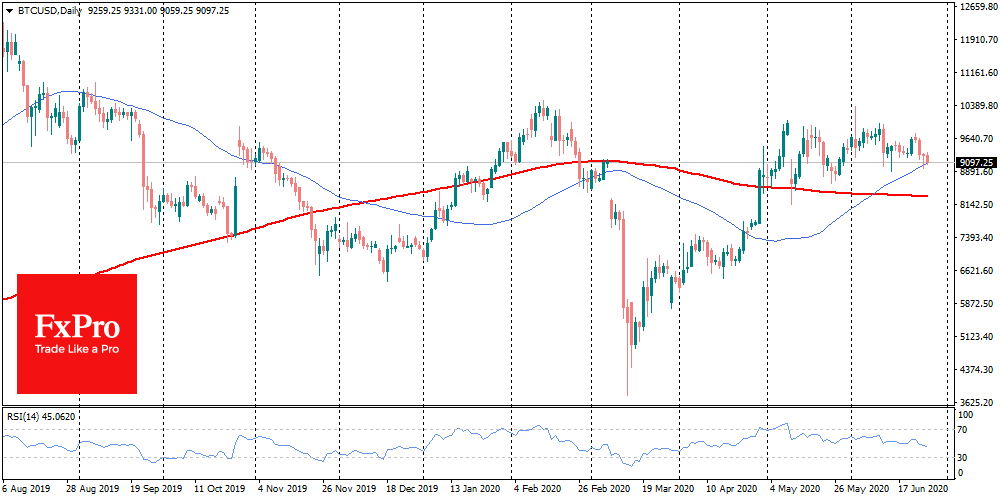

Bulls had managed to keep bitcoin above $9K, and at the end of the week, it is trading near $9200. The pullback from peak levels above $9700 on Tuesday was due to several factors. These include correlation with the global stock market, the liquidation of long $55 million long BitMEX futures contracts, miner sales pressure, and the frustration after failing to grow above $10K.

It is especially worth highlighting the internal factor that affects bitcoin – the sale of coins by miners. In the light of halving, they could not work at a loss forever, which created a stalemate for them. On the one hand, they do not want to lose market share after a decline in rewards and anticipation of price increases. On the other hand, they sell coins to stay afloat, which increase the pressure on its price.

Glassnode found out that on June 24 alone, miners sent 2,650 BTC to exchanges, which shifted downward the price balance. In the short term, the mood of market participants can only improve if Bitcoin can recover at least part of the losses and return to the previous trading range near $9500.

The FxPro Analyst Team