Bitcoin was down 1% on Tuesday, ending the day at around $45.8K. In low-liquid trading at the start of the day on Wednesday, the first cryptocurrency was losing more than 3.5%, briefly dropping to $44.4K, now stabilizing 1k higher. From the levels exactly a day ago, Ethereum lost 4.4%, among other altcoins, the decline prevails, with the exception of a few big names. Terra adds 0.6%, staying close to its highs. Dogecoin is up 7.5%.

The total capitalization of the crypto market, according to CoinMarketCap, sank by 3.6% over the day, to $2.09 trillion. The Bitcoin Dominance Index rose 0.2% to 41.2%. The cryptocurrency index of fear and greed by Wednesday morning lost 5 points to 48 while remaining in a neutral state.

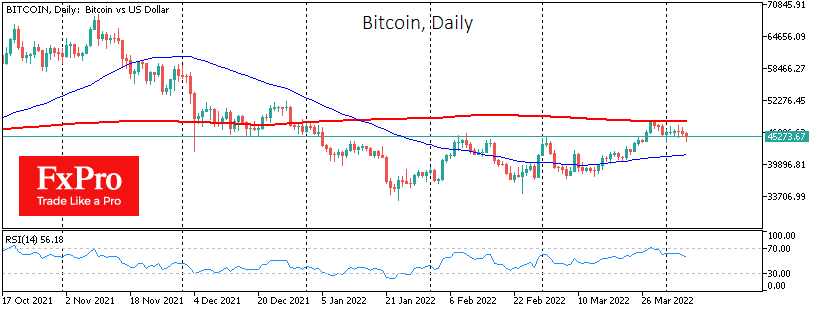

Bitcoin has continued to correct on Tuesday amid a decline in US stock indices. Judging by the market dynamics on Wednesday morning, we saw the triggering of algorithmic stop orders, which quickly sent the price down. However, very soon market participants returned to cautious purchases. Since the beginning of the month, the bulls have clearly not been able to develop an offensive, and we see the predominance of selling on growth towards $47K. On the other hand, support around the $44,000 level is still in place.

Software developer MicroStrategy bought 4,167 bitcoins on credit for $190 million. The company currently owns 129.2 thousand BTC worth almost $4 billion. last days. The fact that even such a large buyer failed to warm up the market makes us look to the near future with caution.

Bloomberg believes that a rally in the current environment is unlikely. The market is entering a bearish phase similar to that of the spring of 2019. Galaxy Digital CEO Mike Novogratz also believes that BTC will be under pressure from the US Federal Reserve to raise rates this year.

Today, US Treasury Secretary Janet Yellen will make her first speech on cryptocurrencies. Her presentation will focus on regulation and investor protection. Yellen has previously criticized digital currencies for their anonymous nature of transactions. The US government has previously indicated that it wants to see cryptocurrencies private but not anonymous.

This is similar to the current principles of the banking system, where the government knows the owners and has the ability by law to seize or restrict access to assets, but these data are generally not disclosed publicly.

The FxPro Analyst Team