Market Picture

Neither the meme mania in equities, the overall positivity in stock indices, nor the weakening dollar seems to be helping cryptocurrencies right now. Crypto market capitalisation is down 0.1% and has been moving around the current $2.29 trillion level for the past seven days.

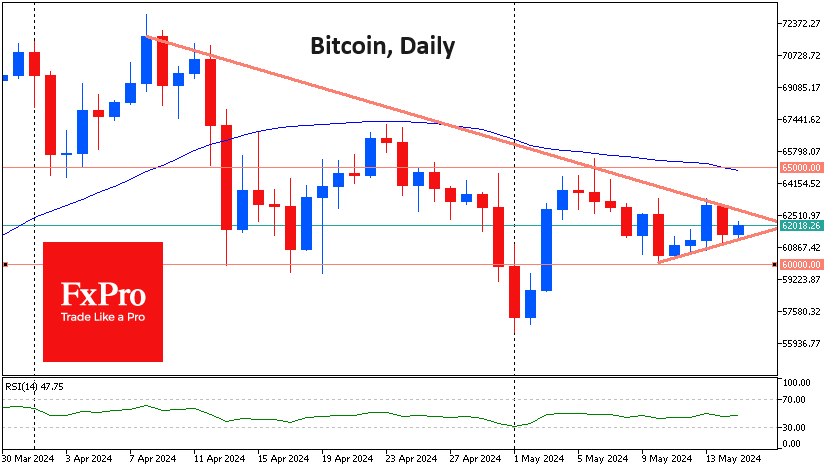

Bitcoin is trading near $61.9K, forming a sequence of higher intraday lows on the daily timeframes. Meanwhile, a month-old downside resistance is still in place. Bitcoin is approaching the top of this triangle, which could lead to a sharp increase in volatility. The trigger in the near term promises to be the US inflation report, which has had a strong impact on markets, including cryptocurrencies, in recent months.

The medium-term picture also indicates that some old altcoins are having a tough time. In addition to Ethereum, Cardano has been consolidating near the lower end of its range in recent months, having already given up more than half of its gains since the lows of October. It pulled back under the 200-day average and formed a “death cross.” Litecoin has also not recovered from the powerful blow in April, testing its 200-day average.

XRP is trading around the $0.5 level, a historically important level that has seen prolonged consolidation since September 2022. An upward support line can be drawn through the area of the lows of the last two years, but XRP fell below it on 12-13 April. This line worked as resistance for the next two local peaks at the end of April and the beginning of May. All this sets up a bearish scenario with a pullback to the long-term support at $0.25-30.

News background

Onchain indicators indicate that Bitcoin is experiencing a phase of consolidation and potential correction. Glassnode warned that market participants should exercise caution and consider the possibility of panic selloffs.

According to Bernstein, Bitcoin’s lateral consolidation post-halving is great for public miners in their competition for hashrate. However, Kaiko believes risks of a large-scale sell-off of BTC by miners because of a sharp drop in post-halving revenues may be growing in the market. According to Blockchain.com, the average daily revenue of Bitcoin miners has rolled back to 2023 levels.

Solana could rise to $400 by November 2024, and the catalyst for the rally will be a wave of meme coins dedicated to the US election campaign, Merkle Tree Capital suggested. Jeo Boden (BODEN) and Doland Tremp (TREMP) meme-coins helped Solana surpass Ethereum in trading volume.

According to Wublockchain, spot trading volume on major crypto exchanges fell nearly 38 per cent in April. Against this background, traffic on the largest exchanges fell by an average of 22%.

According to Deribit, the options market has increased bets on Ethereum, rising above $3600 in June.

The FxPro Analyst Team