Market Overview

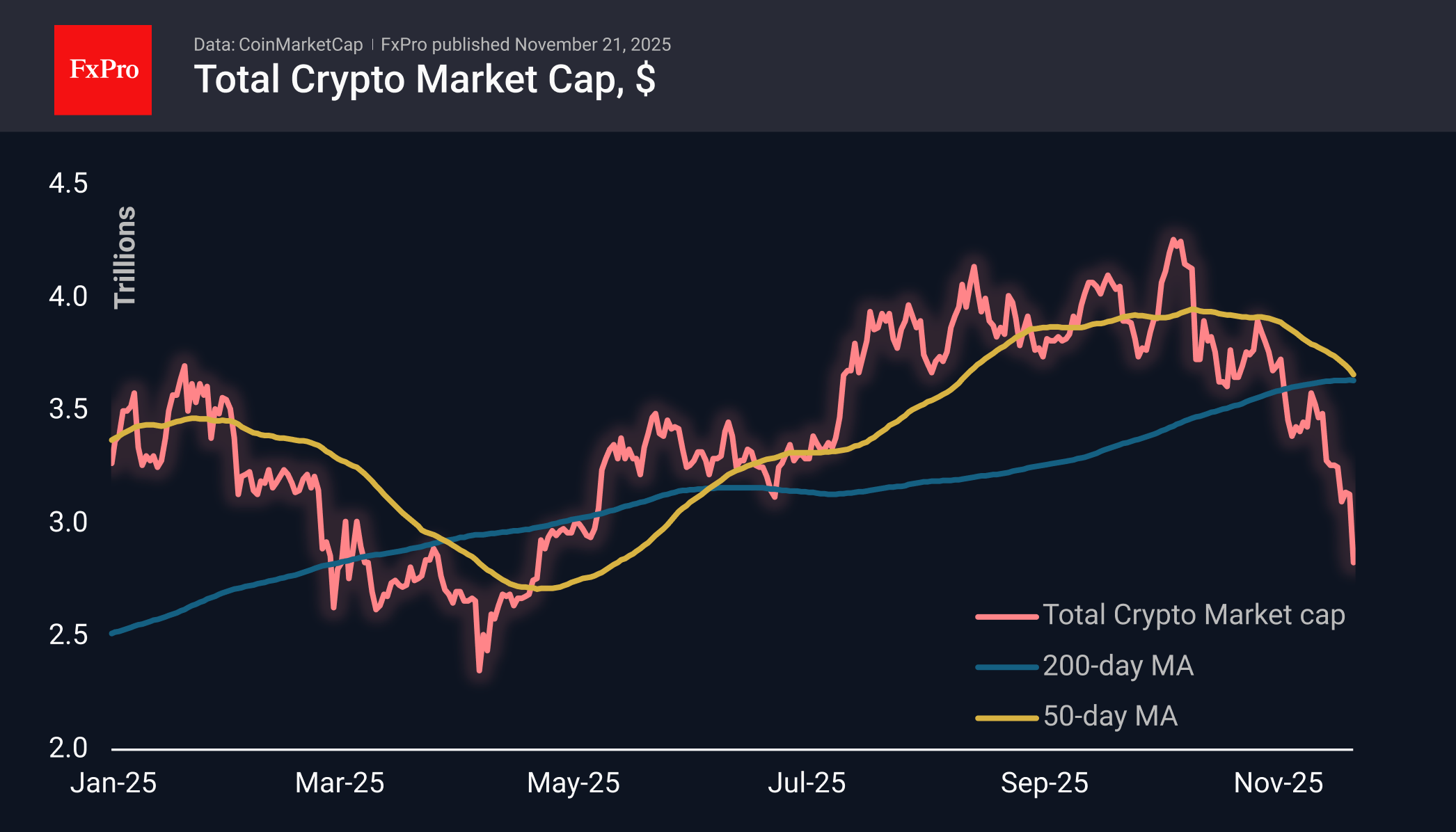

The crypto market capitalisation plummeted by more than 9% to $2.82 trillion, reaching its lowest level since the end of April. This already appears to be a real liquidation of margin positions. The following technically necessary support line seems to be the $2.4 trillion area. The market found support here in early April 2025 and consolidated around it throughout April 2024.

Bitcoin is trading below $83K, and at its lowest point fell to $81K, starting the day at $88K. The timing and scale of the dynamics suggest a wave of margin calls in the early hours of Friday, with an attempt at stabilisation during the European session. The price of Bitcoin has returned to the stabilisation levels seen from late February to mid-April. The RSI index on the daily charts has fallen to 20, where it last stood before the massive rally in August 2023. Touching this level in mid-2022 was not far from the price’s bottom (10% higher), but the reversal then took 6 months to materialise.

News Background

CryptoQuant indicates that market conditions for BTC have become the most bearish since the start of the bull cycle in January 2023. A break below the average investor entry price of $82,000 would be the first serious confirmation of a bearish trend since May 2022.

Bitcoin could fall to the $60,000-80,000 range and remain there until the end of the year if the Fed refuses to cut its key rate on 10 December, XWIN Research warns. Currently, the market estimates the probability of it remaining at its current level at 58%. On the other hand, crypto exchanges have accumulated record reserves of stablecoins worth $72 billion.

The unprecedented pace of Ethereum accumulation by institutional investors poses fundamental threats to Ethereum, said ETH co-founder Vitalik Buterin. Currently, nine Wall Street giants, including BlackRock, as well as several dozen DAT companies, have accumulated 10.4% of the total supply of the leading altcoin.

The launch of BlackRock’s staking-enabled Ethereum ETF poses a threat to the business model of DAT companies, such as BitMine, which accumulate cryptocurrency, according to 10x Research. Investors cannot exit such structures without significant losses.

Cryptocurrency-backed lending reached $73.6 billion at the end of the third quarter, surpassing the previous record set in 2021, according to Galaxy Research.

The FxPro Analyst Team