Market picture

The cryptocurrency market has regained its cap to above $1.18 trillion (+1.6% in 24 hours). The market’s initial rebound on buying back the most sagging assets was supported by the unexpected news of Fitch downgrading the US long-term rating on Wednesday, which triggered an impulsive pull into Bitcoin and gold.

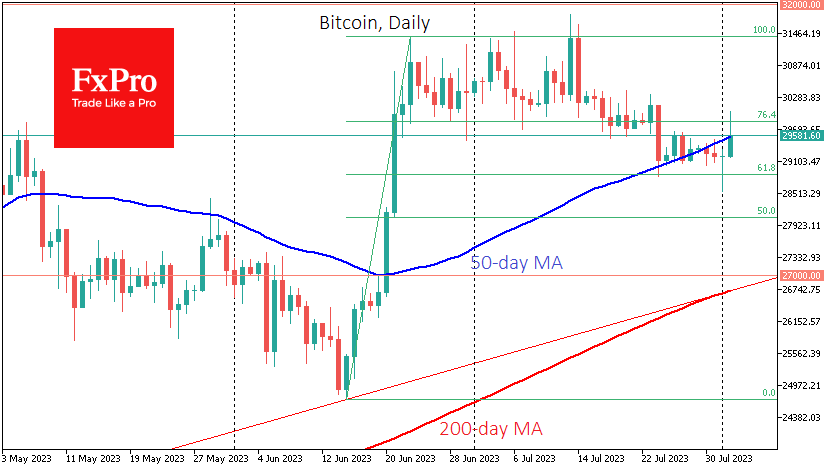

Bitcoin fell to $28.6K on Tuesday, hitting lows since June 21 amid market concerns over the Curve Finance hack and a likely drop in liquidity on the AAVE platform. The first cryptocurrency experienced impressive upward momentum, touching $30.0K early Wednesday morning. Although we do not see the realisation of a rapid decline scenario, for Bitcoin now, the 50-day moving average plays the role of resistance. The chances of a rapid decline will increase sharply with Wednesday’s close below $29.2K.

News background

TRON founder Justin Sun unexpectedly withdrew about $52 million in stablecoins from the decentralised finance protocol AAVE, impacting borrowing rates. In parallel, Sun announced a partnership between Tron and Curve. These actions stopped the slide of confidence in the cryptocurrency market and brought some speculative buyers back.

A positive signal for Bitcoin could be an increase in the reserves of mining pools. They reduced sales of cryptocurrency and resumed its accumulation, noted in CryptoQuant.

The U.S. will tax income from staking. The US Internal Revenue Service (IRS) has issued a new clarification, according to which the funds received from staking are considered income and should be taxed.

Tether, the issuer of USDT, the largest USDT stablecoin by capitalisation, reported excess reserves of $850 million, formed at the end of the second quarter of 2023.

The FxPro Analyst Team