Market Overview

The cryptocurrency market capitalisation fell by 2.7% to $2.94T. Buyers failed to keep the market above the $3 trillion threshold but managed to stabilise prices for key cryptocurrencies above last month’s lows. Bitcoin lost 4%, Ethereum and XRP lost about 6%, and Solana lost 5%. These major coins, which have ETFs, now appear to be victims of changing institutional sentiment.

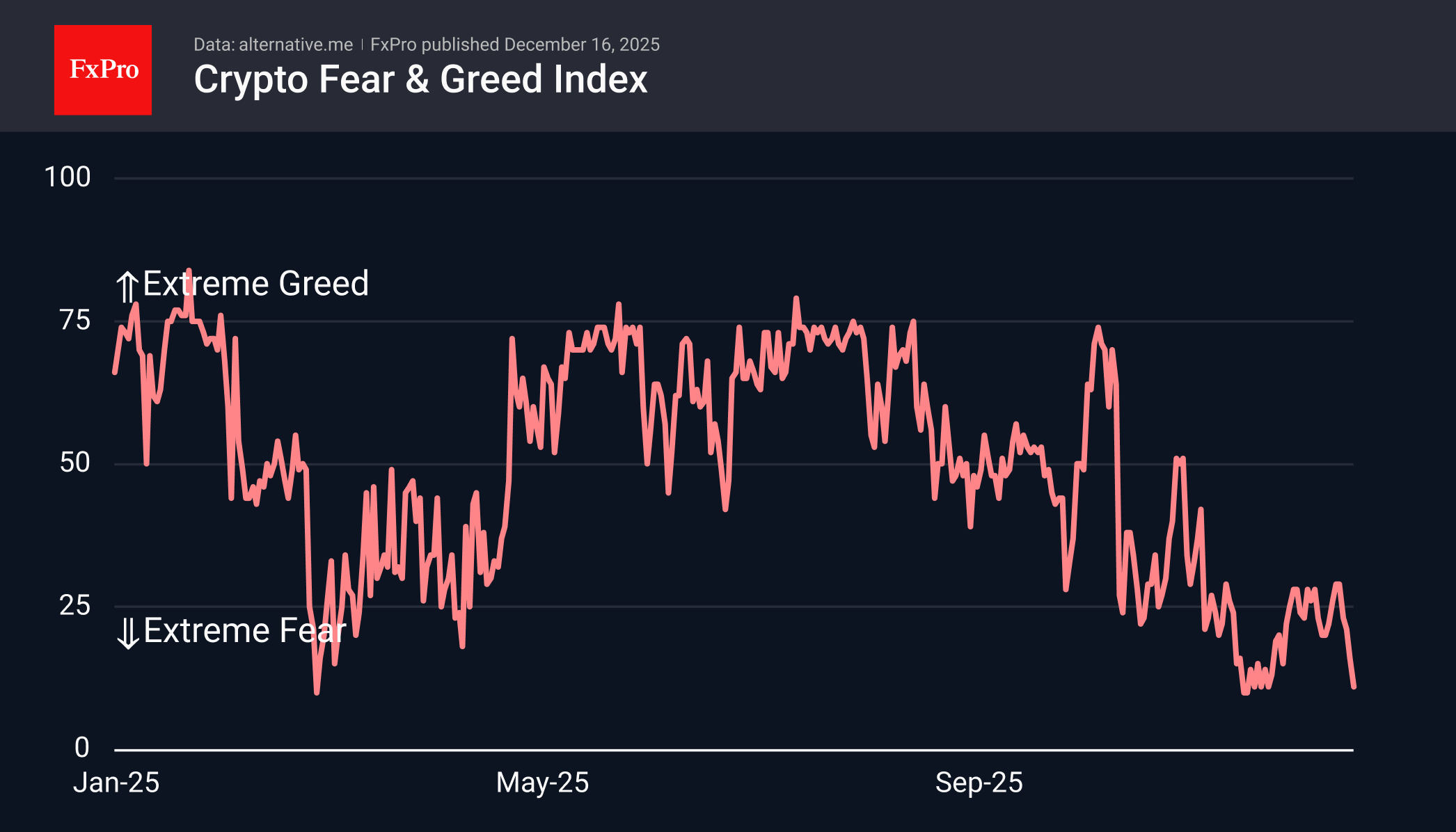

The sentiment index fell to 11, rolling back to its lowest level in precisely one month. Such a deep dive into the fear zone confirms that we are seeing more than just an interim correction, which occurred in February and April.

Bitcoin fell below $85K on Monday, marking a decline for four consecutive days. Active selling began with the start of active trading in the American session. This is likely the result of a portfolio rebalancing at the end of the year, as well as another wave of interest in cryptocurrencies from corporations and institutions, which drove the price up from April to August. It appears that the next significant support level will now be in the $81K range, where the November lows and the March support range for the outgoing year are concentrated. The golden support level is in the $60K-$70K range, where the key resistance levels for 2021 and 2024 are located.

News Background

Market liquidity is declining as the year comes to a close. Leverage remains low, with market participants closing positions and optimising balances, avoiding risky bets, according to FlowDesk. The decline in liquidity is exacerbated by historically low volumes of cryptocurrency trading on platforms.

The current Bitcoin rally appears to have come to an end. Before the next major upward movement, a deeper correction phase is likely, possibly to around $50,000, according to CryptoQuant.

Companies holding Bitcoin in reserves continue to ‘selectively but steadily accumulate’ the asset. However, the buyer base has expanded significantly: not only miners are active, but also tech giants and financial firms, Glassnode notes.

Strategy bought 10,624 BTC ($980 million) over the past week, repeating the scale of purchases from the previous week, which was the highest since July, and made one large purchase of bitcoins, in the same amount as a week before. Strategy now owns 671,268 BTC with an average purchase price of $74,972 per bitcoin.

Bitcoin’s hash rate declined by 17.25% over the week due to the potential closure of mining farms in Xinjiang, China, according to BlockBeats. The Chinese authorities’ measures may have been a response to a Reuters article published in late November, which claimed that the mining sector in China was experiencing a ‘quiet revival’ — the country’s share of the global hash rate had grown to 14%.

The FxPro Analyst Team