Market picture

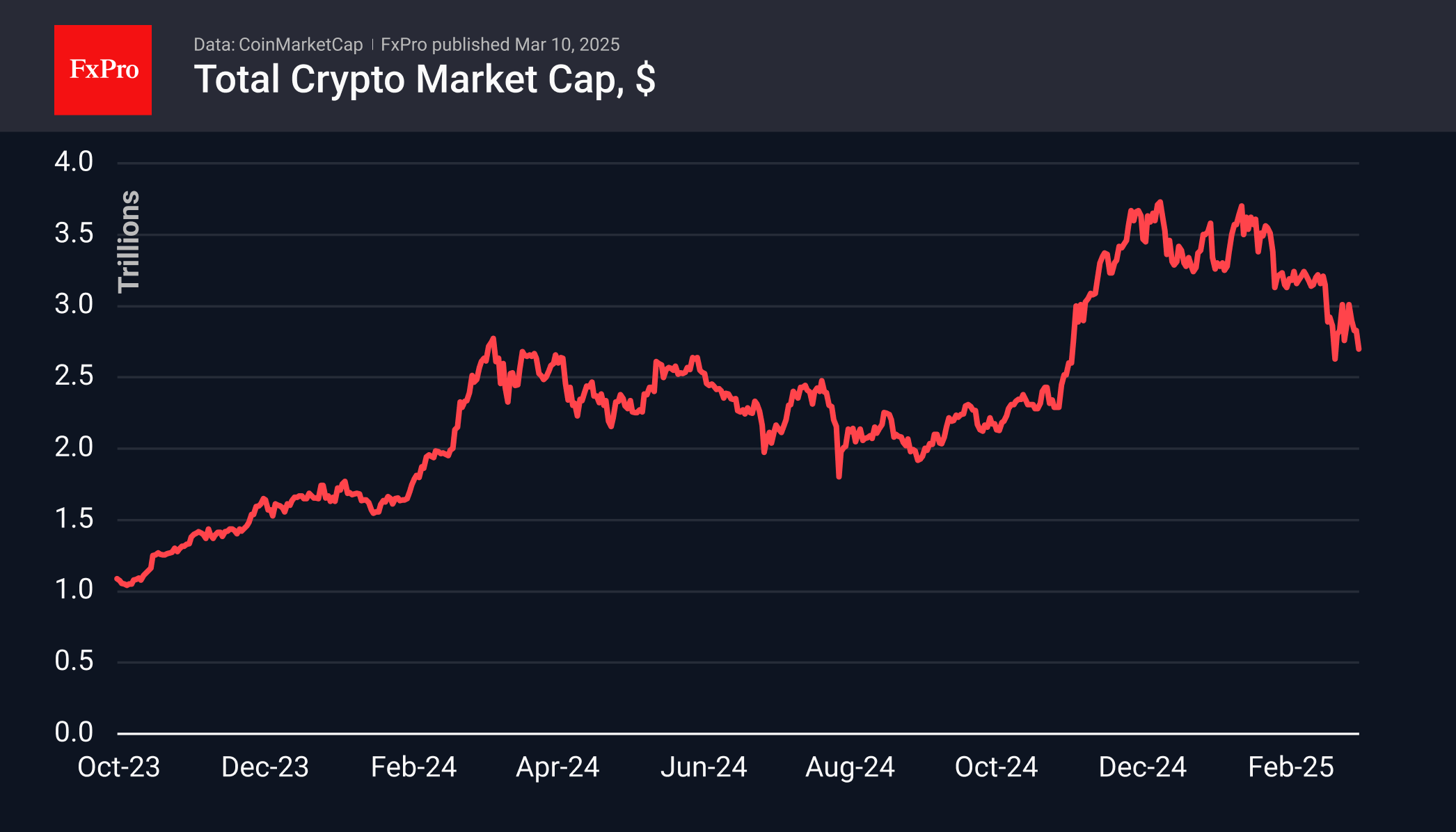

The crypto market is down 4% in the last 24 hours to $2.7 trillion and has been under selling pressure since Sunday afternoon. This can be attributed to a desire to convince the community of the Crypto Summit’s weak results, even though the outcome was quite predictable and not that bad. Trading volumes over the weekend were extremely low, reducing the value of the bearish signal.

Bitcoin slipped below $80K at the start of Monday’s trading, only to recover to $82K by the start of active European trading, still below the 200-day moving average. A consolidation in this area at the end of the day could accelerate the sell-off and bring in new sellers. We note that sellers push the price down in periods of low liquidity, but the price bounces back with the arrival of institutional buyers. It looks like the big buyers have enough liquidity left to buy out the drawdown.

News background

According to SoSoValue, net outflows from spot bitcoin ETFs totalled $799.4 million last week, down from a record $2.61 billion the week before. The negative trend was seen in all five trading sessions. Cumulative inflows since the launch of bitcoin ETFs in January 2024 fell to $36.14 billion.

The ETH ETF saw net outflows of $119.8 million for the week. Cumulative net inflows since the ETF’s launch in July fell to $2.70 billion (-4.3% for the week).

At the White House Crypto Summit on Friday, Trump noted that government agencies would “explore ways to acquire additional BTC for the reserve”, provided it doesn’t involve taxpayer money.

According to Bitcoin Treasuries, there are 198,109 BTC stored in US-controlled wallets. However, around 120,000 BTC need to be returned to the Bitfinex exchange.

The social media sentiment index for Ethereum has fallen to its lowest level in a year, a sign of a turnaround as the broader market stabilises, according to Santiment.

The FxPro Analyst Team