Market Picture

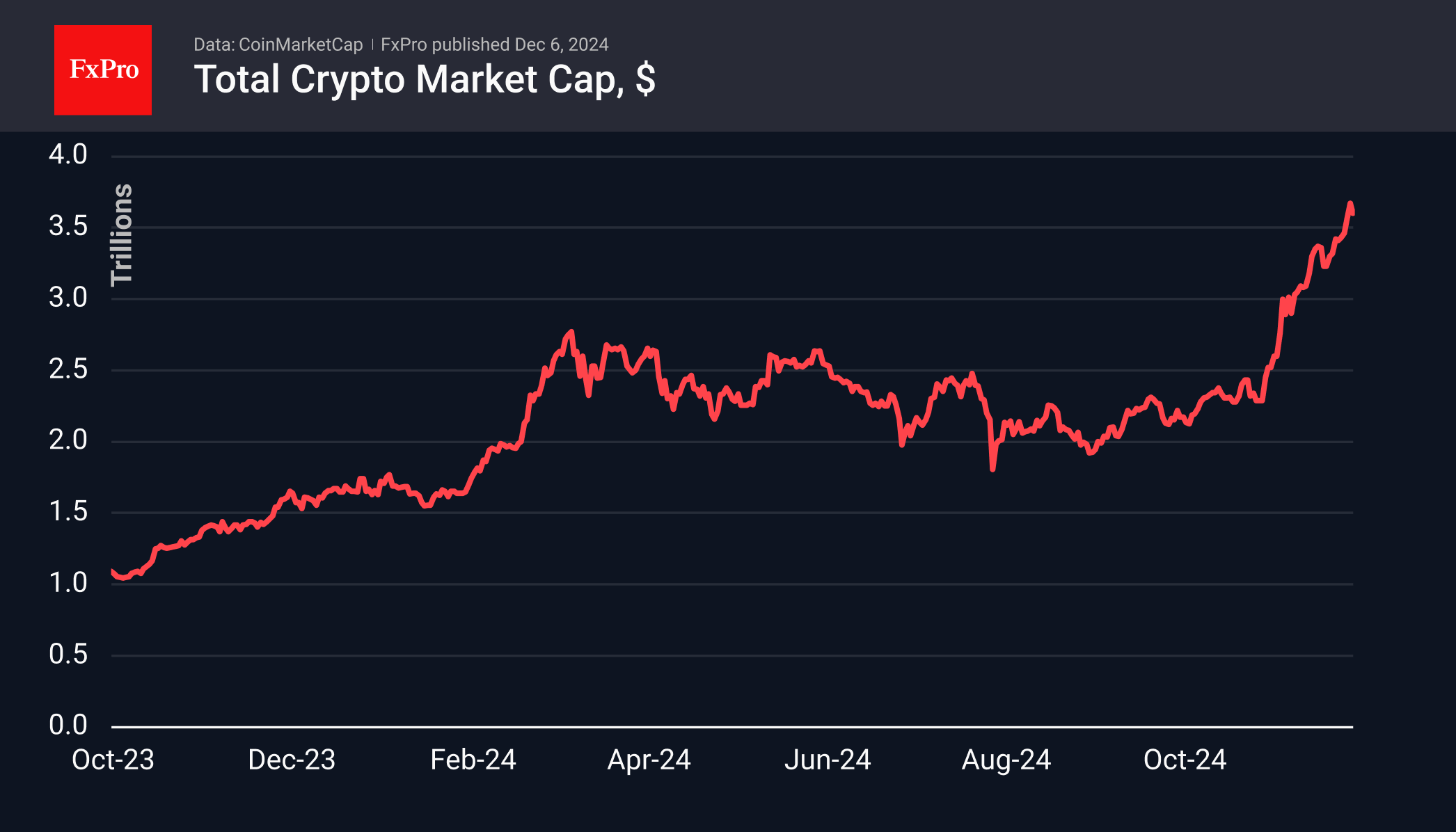

The crypto market cap has shrunk to $3.6 trillion, down around 2% in the last 24 hours. The main volatility has been in Bitcoin, with Ethereum affected to a lesser extent and a barely noticeable ripple at the altcoin level. This is a strong signal of a short-term shakeout but not a change in sentiment.

Thursday’s US session saw a strong wave of profit-taking, which quickly turned into a liquidation of marginal long positions. Both bullish and bearish liquidation created a swing range of almost 13% in less than 24 hours. At its lowest point, the price of Bitcoin was down to $91,000. By early European trading, it had stabilised just below $98,000, back to where it started the day on Thursday.

Other stars of recent flights are also cooling off. Tron has stabilised around $0.32, roughly in the middle of this week’s range. XRP is cooling off, pulling back to $2.30, which is near the 76.4% level from the early November lows.

News Background

There is a strong correlation between Bitcoin’s rise above $100,000 and Tether’s increased supply of USDT stablecoin, said CEO Paolo Ardoino. Over the past 20 days, the stablecoin’s capitalisation has increased by approximately $16 billion.

CryptoQuant identified significant institutional demand from US investors based on Coinbase’s premium dynamics.

Mining company Hut 8 will sell $500 million worth of shares. The funds will be used to expand the company’s data centre infrastructure and to purchase Bitcoin as a strategic reserve.

Venture capital firm Andreessen Horowitz (a16z) sees the integration of AI with blockchain, tokenisation and stablecoins as key areas of development for the crypto industry in 2025.

Justin Drake, one of Ethereum’s core developers, said the Solana network, touted as a “killer” of Ethereum, is not really a threat or even a direct competitor.

Arkham Intelligence noted that the bankrupt Mt. Gox exchange moved 24,052 BTC ($2.47 billion) to an unknown address. This is the first major move of the exchange’s assets since 12 November, when the platform sent 2,500 BTC to two unknown addresses.

The FxPro Analyst Team