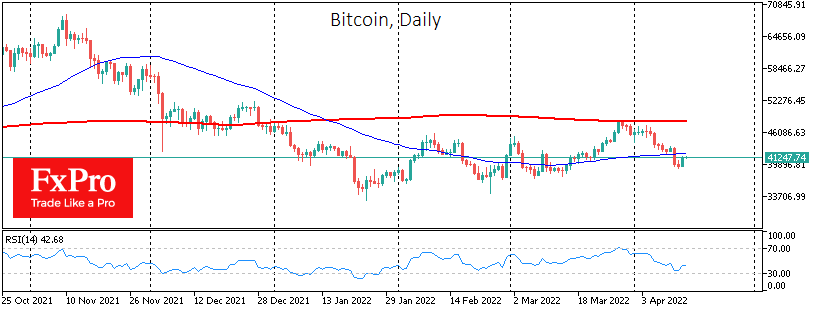

Bitcoin rose 4.3% on Wednesday to end the day around $41,300, Ethereum added 4% to reach 3100, and both remain near those levels early Thursday. The leading altcoins from the top ten have risen in price over the past day from 0.7% (Binance Coin) to 5.4% (Avalanche).

According to CoinMarketCap, the total capitalization of the crypto market has grown over the past 24 hours by 2.3% per day, to $1.92 trillion. The Bitcoin Dominance Index rose 0.3% to 41.0%.

Cryptocurrency index of fear and greed added to Thursday added 3 more points to 28 and moved into a state of “fear”.

Bitcoin was in demand in the US session amid a rebound in stock indices and a decline in the US dollar. The US currency began to correct downwards after a 9-day growth, which contributed to the revival of all risky assets.

Alex Mashinsky, CEO of the Celsius Network crypto-lending platform, said that Bitcoin will soar above $100,000 as early as 2022 because of capital flight from the stock market to cryptocurrencies. According to him, bitcoin began to behave as a protective asset against the backdrop of a deterioration in the general situation in the world.

Crypto lending platform Nexo has announced the release of the world’s first credit card secured in cryptocurrency based on the Mastercard payment system. The card will allow you to spend funds without having to sell crypto assets. They will be used as collateral to secure the loan.

According to IntoTheBlock, the number of long-term investors in the Shiba Inu token has grown 20 times since the beginning of the year. However, hodlers hold only 5% of the total capitalization of the meme token.

The FxPro Analyst Team