Bitcoin is down 3.6% over the past week, ending near $29,900. Ethereum lost 5.8%, while other leading altcoins in the top 10 fell from 5.4% (XRP) to 9.2% (Cardano). The exception was Binance Coin (+3.3%).

According to CoinMarketCap, the total capitalisation of the crypto market has changed little over the past seven days at 1.29 trillion, as the decline at the beginning of the last week was largely reversed by its end.

By Monday, the cryptocurrency fear and greed index is down 4 points to 10.

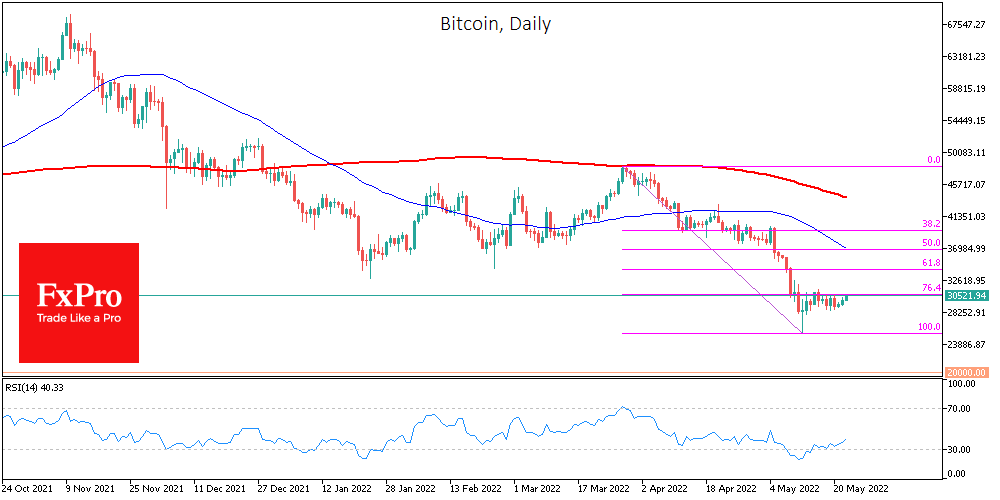

Bitcoin has declined for seven consecutive weeks amid a sell-off in stock markets. Bitcoin is in its 13th day of trading through the $30K level. Over the weekend, we saw almost traditional buying by retail investors, but their strength only allowed them to bounce back from Friday’s losses.

If we look at Bitcoin as a leading indicator of risk demand rather than tailing off moves in the S&P500 or Nasdaq, we may well be in a situation where the tail rules the dog.

Galaxy Digital CEO Mike Novogratz said that the altcoin market will collapse by another 70% with US Fed policy and a bearish trend.

Microsoft co-founder Bill Gates said he only invests in assets that “deliver returns”. In his view, cryptocurrencies do not fall into that category.

Billy Marcus, one of the creators of Dogecoin, said the cryptocurrency market is a mix of unhealthy optimism, FOMO, panic, scams, gambling, and widespread stupidity. He said he has not been involved in the DOGE project for more than 7.5 years but describes himself as a coin supporter.

ECB head Christine Lagarde said that, unlike central bank digital currencies, cryptocurrencies have no value and are not based on anything.

A group of G7 finance ministers pointed to the importance of accelerated legislation to regulate digital assets following the collapse of the UST stable coin and LUNA cryptocurrency.

The FxPro Analyst Team