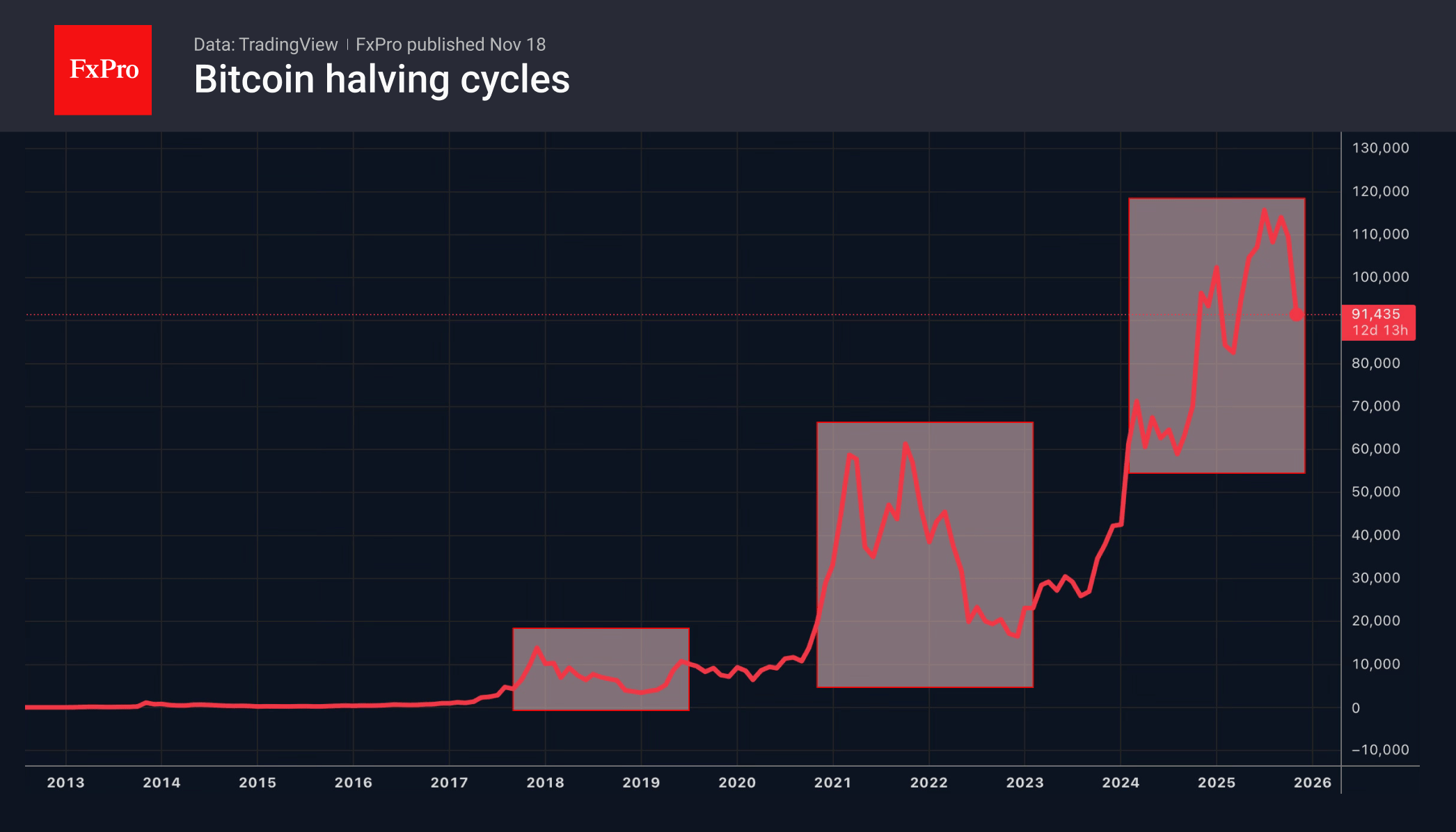

They say that when uncertainty is at its peak, revert to established models. In the autumn, Bitcoin’s ties to traditional assets, including indices, the dollar, and gold, were severed. Investors returned to the good old pattern of four-year cycles tied to halving.

The last halving was in April 2024, with Bitcoin reaching a record high in October. It was then time for a pullback. In previous cycles, they exceeded 50%. To avoid losing money, holders decided to act pre-emptively. According to CryptoQuant, crypto whales have dumped 815,000 coins over the past month. This is the most serious sell-off since the beginning of 2024.

The transition of Bitcoin to a bear market has created problems for institutional investors. In mid-November, Strategy’s capitalisation fell below the value of the bitcoins it had acquired. However, while Michael Saylor’s company is using the pullback to buy, other corporate treasuries are faced with the choice of taking losses or selling.

Add to this the outflow of capital from ETFs, and the increase in supply and decrease in demand make the downward trend in Bitcoin logical. At the same time, there is a growing belief in the market that cryptocurrency is responding to macroeconomics.

Indeed, Bitcoin’s 32% collapse from its January peak to its April low was linked to the White House’s announcement of the most extensive tariffs since the 1930s. In October, Donald Trump threatened China with 100% import tariffs, after which Bitcoin prices plummeted by 28%. Tariffs carry inflation risks and prevent the Fed from lowering rates, worsening global risk appetite.

The fall in US stock indices is also due to concerns about a tech bubble. Their fundamental valuations have long been considered overpriced. However, investors turned a blind eye to this, hoping for a softening of policy. Disappointment has led to a sell-off of riskier assets and Bitcoin has not been spared.