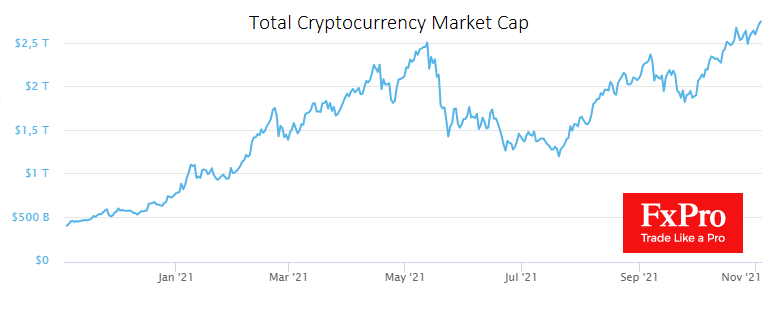

Over the past 24 hours, the crypto market capitalisation grew another 3% and has surpassed $2.7 trillion, hurtling towards new all-time highs. At the same time, the price of bitcoin has increased by 2%, clearly indicating that cryptocurrencies are on a broader growth trajectory.

Bitcoin briefly climbed above $64K overnight but pulled back to levels just below $63K on Wednesday morning. The RSI on the daily charts is at 60, stepping down after the October rally and reflecting that the market has cooled enough to clear the way for growth. The crypto Fear & Greed Index jumped to 76, one-week highs, indicating a shift in crypto-enthusiasts focus, but not wariness in general.

Bitcoin reaching new all-time highs earlier last month encourages the search for potential new crypto stars with more room for growth.

The search for these ideas we divide into two streams. The first is an increase in purchases of top altcoins. These are the one or two dozen coins with relatively high capitalisation and a long history, the blue chips of the crypto market.

First and foremost is Ether, which attracts with its long history and uses in multiple projects. Although transactions are pretty expensive, the developers are on their way to solving this problem, even if this way is broken up into many stages stretching over the years. In recent months, the project’s main killer feature has been burning coins for transactions on the network, which enthusiasts call deflation. (Though economists can hardly attribute a steady price decline to the fact that the rate at which crypto coins are burning is outstripping the rate of creation.)

Another area of search for crypto-enthusiasts and speculators in the industry is new projects, promising infrastructure or ideas, or good PR. The best PR man of our time, Elon Musk, is a nice bonus. In terms of PR, what matters is not the coin itself but the extent to which its followers manage to maintain the hype and thereby promote its ever-widening acceptance.

Shiba Inu and Dogecoin are perfect examples from this point of view, as both managed to break into the top ten most capitalised coins (excluding stablecoin USDT). The total value of all coins of each of these projects exceeds $35 billion.

Sandbox is also worth a look among the increasingly popular coins. Despite a relatively modest 8% growth per day, it has gained more than 240% in seven days. It is more than a year old, but it falls out of speculators’ sight during periods of market lull, actively accelerating only during periods of market love for altcoins, like now.

The coin stands out for its trading turnover, which has exceeded $5.27bn in the last 24 hours, putting it in fifth place behind Bitcoin (36.6bn), Ethereum (21.1bn) and XRP (5.29bn). Again, we put stable Tether (86.3bn), and Binance (7.34bn) in a different category as they are intermediaries for crypto players and interest in them does not affect the price.

The FxPro Analyst Team