Market Overview

The crypto market jumped 4.5% in the last 24 hours, following reports of progress in ending the US government shutdown and promises by the US president to distribute $2,000 checks to families, with the funds received from tariffs. The positive effect of this news has been amplified by the fact that a more than 20% pullback from the peak has fuelled greed. Among the top coins, Ethereum (+5.8%) and XRP (+8%) are growing steadily, outperforming Bitcoin, which is up 4.5%.

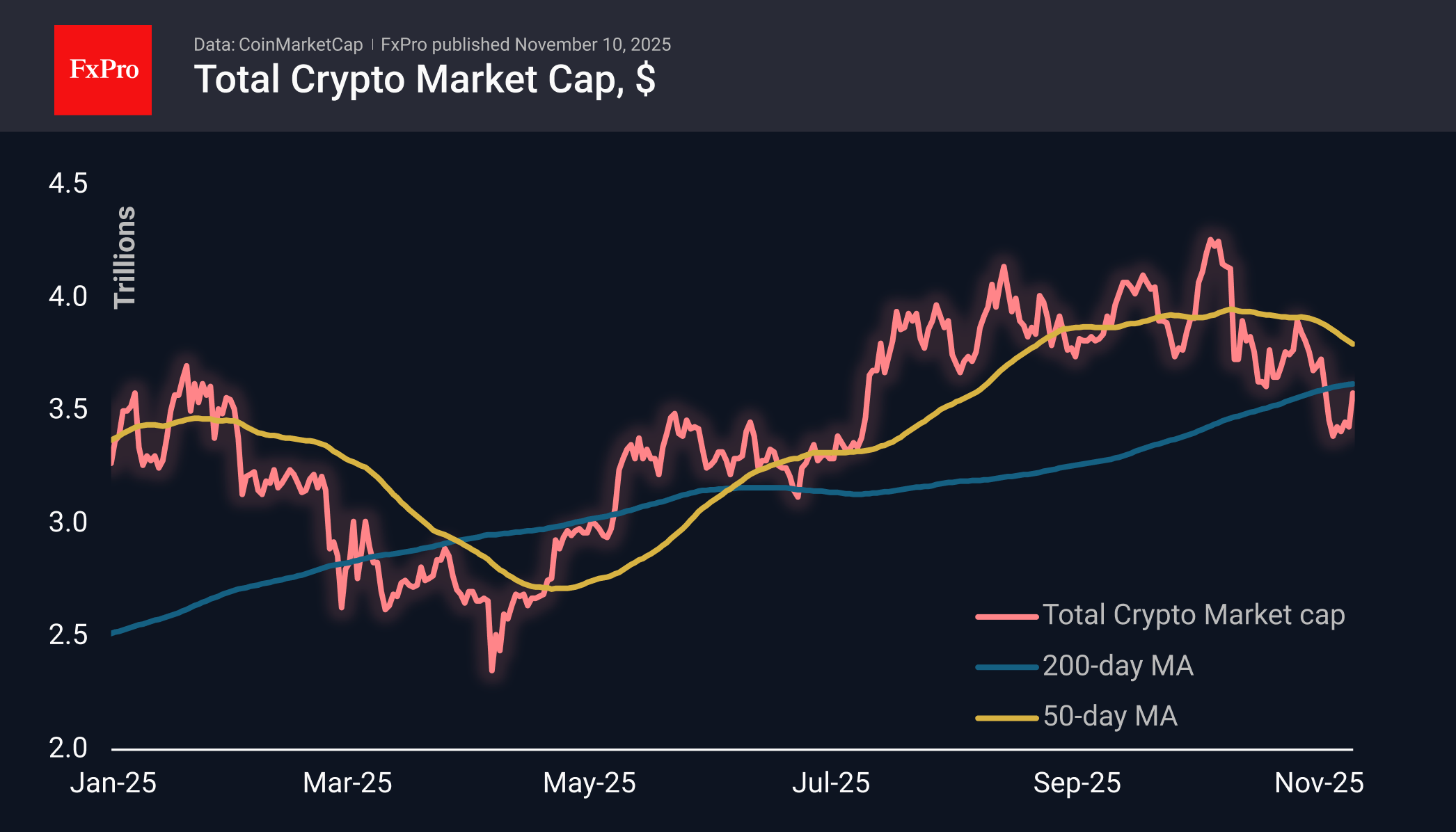

Bitcoin surpassed the $106K mark, breaking out of the $99K–$104K consolidation zone, where it spent most of last week. At the same time, the first cryptocurrency is trading below its 50- and 200-day moving averages. Moreover, a death cross is forming there, as the first of these averages is about to fall below the latter.

The technical picture for Ethereum is more favourable, as the bulls did not allow the coin to consolidate below the 200-day MA and pushed it up on the latest positive news. From current levels near $3,600, the nearest target for buyers appears to be $4,000, which promises to be a significant indicator of market health.

News Background

Following the market crash on October 10-11, whales sold 32,500 BTC, while small investors actively bought on the dips. This is an alarming sign for Bitcoin, as historically, prices tend to follow the direction of whales, according to Santiment.

Bitcoin’s deleveraging phase is ‘largely complete’ after the sell-off. The first cryptocurrency could rise to $170,000 over the next 6-12 months, according to JPMorgan’s forecast.

The ‘sluggish dynamics’ of the crypto market are linked to the rebalancing of hodlers’ portfolios. This may have a negative impact in the short term, but is beneficial in the medium and long term, said Galaxy Digital founder Mike Novogratz.

ARK Invest CEO Cathie Wood said she was forced to revise her long-term forecast for Bitcoin for 2030 from $1.5 million to $1.2 million. She cited the rapid growth of stablecoins, which are displacing BTC among investors in emerging markets.

According to a survey by the Alternative Investment Management Association (AIMA) and PwC, 55% of traditional hedge funds owned cryptocurrencies in 2025. Last year, the figure was 47%.

Ripple denied plans to hold an IPO. The company does not intend to go public in the near future, following the example of several participants in the cryptocurrency industry.

The FxPro Analyst Team