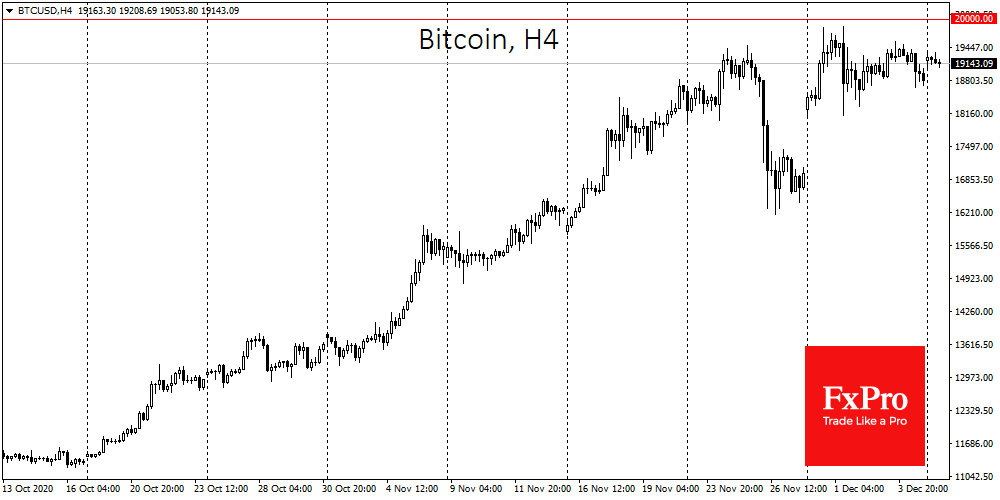

Bitcoin held the price level above $19K at the end of last week, and at the beginning of the new working week, it is trading around $19,300. If we compare current trading volumes to the beginning of last week, we can see a clear decline by half to $25 billion. So although the market is not falling, traders do not support the current dynamics and are mostly in standby mode. Nobody wants to be an early seller or a late buyer. Meanwhile, the Crypto Fear & Greed Index remains in “extreme greed” mode at 94, indicating a high potential for a correction.

The traditional market has attracted a lot of attention due to renewed growth in stocks, gold, and oil. Against this background, the crypto market is waiting for new triggers. Since the current price dynamic is managed by institutional investors, we may well see waves of decline and increasing interest depending on what happens within traditional assets.

Last week Bitcoin lacked quite a bit in testing the most important technical and psychological level of $20K. This significant test will likely take place this week and after exceeding $20K we will face another profit-taking, which will be enough to launch a correction.

The news around MicroStrategy’s purchase of Bitcoins at the price close to $19,500 may become an important factor of Bitcoin support this week. The company bought $50 million worth of coins, while in total they own almost 41K BTC. Although compared to the traditional market, this is a relatively small investment, nevertheless, such an injection may be a very tangible positive impulse for the crypto market.

Crypto market participants are afraid that the outgoing Trump administration may tighten the crypto regulation. However, in this context, we are constantly in uncharted territory. The Democrats also do not guarantee a positive attitude towards Bitcoin and other digital currencies. It should be noted that judging by the reaction to Facebook’s intention to rebrand Libra and launch a stablecoin called Diem, difficult times await stablecoins in general. If the bill on the regulation of stablecoins turns into a law, it will hit not only Diem. The huge industry around Tether (USDT) will be forced to look for new ways of transferring cryptocurrencies into fiat and taking profits.

The FxPro Analyst Team