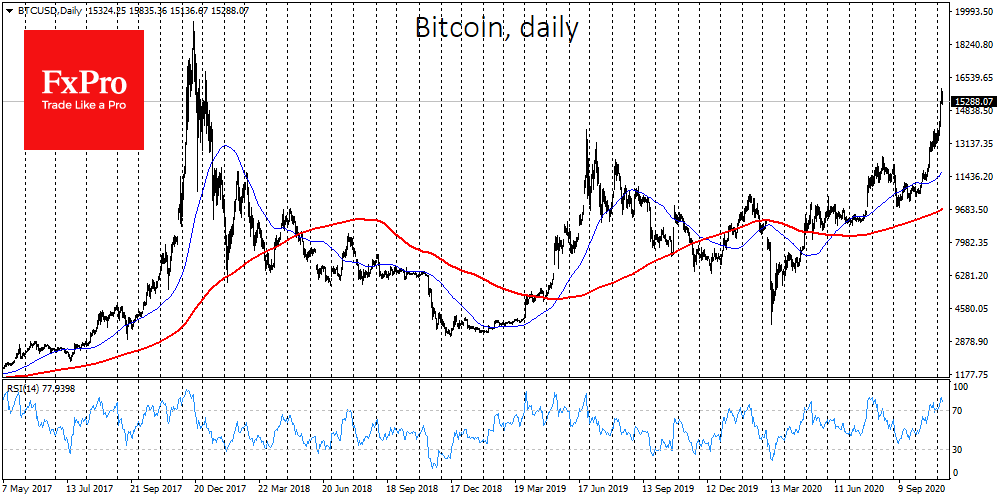

Biden won the election, and Bitcoin managed to stay above $15K. This is the main news of the past week and the weekend. Bears tried to initiate a Bitcoin correction on Saturday, but the decrease to $14,500 attracted buyers. Nevertheless, if you look at the Crypto Fear & Greed Index for Bitcoin and the largest crypto coins, the picture is quite alarming.

The indicator jumped 8 points in a day to “90”, which corresponds to the “extreme greed” area. The indicator shows that the asset is extremely overbought, hinting that a correction is approaching. The index reached its current value at the end of June 2019, when the BTC was approaching $14K and has been falling since then. The extreme overbought condition for the crypto market does not mean an immediate reversal to a decline. On the contrary, the FOMO rally may even intensify soon, causing an avalanche-like closing of short positions. But the stalling of growth can quickly reverse the entire market, as investors will hurry to take profit from the recent rally.

After the U.S. elections, crypto market participants are trying to guess what attitude the new administration will have towards cryptocurrencies in general and Bitcoin in particular. Donald Trump had a very negative opinion about Bitcoin, but in reality, we did not see any serious pressure on the first crypto coin. The infrastructure for investing in BTC has only improved, and the volume of investments has also grown significantly. Conversely, the Facebook project faced an extremely fierce reaction from the regulators.

In theory, the political line of the Democrats, the willingness to stimulate the economy and the provide more substantial “epidemic support” should, in the end, create more significant inflation. This, in turn, should be positive for Bitcoin and other crypto coins. However, the fact that Biden did not speak negatively about Bitcoin does not mean that some key posts in the new administration will not be occupied by BTC opponents.

The week following the election will be very important for Bitcoin and the sector as a whole. Current levels are very high from a historical perspective, and a massive correction is not starting due to investors’ fear of being among the early sellers. Stability above $15K supports positive investor sentiment, but if Bitcoin’s price trend starts to lean more and more towards $14K, we will get many factors for a “perfect storm”. Bitcoin should convince most market participants that there is significant space and power for growth towards $20K.

The FxPro Analyst Team