Over the past 24 hours, total crypto market capitalisation rose by 2.1% to $2.24 trillion, recovering to the levels at the start of the week. Yesterday, the figure was close to the $2.0 trillion mark, but demand for risk assets recovery supported cryptos, providing around a 12% rise from the bottom to peak in the following four hours.

On balance, the cryptocurrency fear and greed index reclaimed another point, rising to 29.

The bulls seem to be putting in the necessary minimum effort to keep the positive picture on the charts of the major cryptocurrencies. But there isn’t much more to do now.

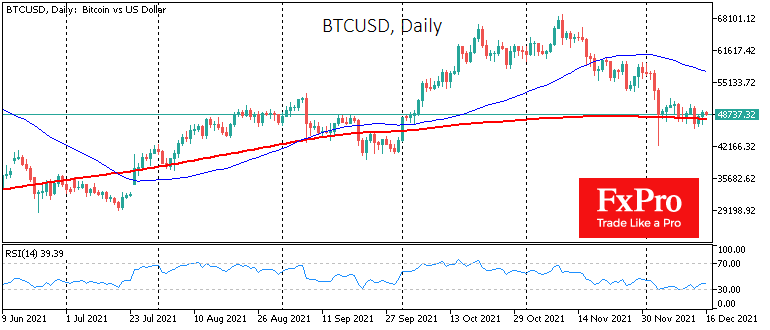

Bitcoin is up 1.2% in the last 24 hours, trading at $48.7K. The bulls managed to push BTCUSD into the area above the 200-day moving average but are not getting away from it.

Ethereum is adding 3.5%, clinging to the $4K. The strong market reaction after the FOMC pushed ETHUSD above this round level, but we saw some selling pressure in the morning. Short-term traders should closely watch whether the former support has turned into resistance.

The pair of major cryptocurrencies appear to have been supported by a general increase in risk appetite in the markets following the FOMC announcements. However, investors should keep in mind that this upward move in traditional financial markets was more of a “buy rumours, sell facts” style reaction.

Fundamentally, news about the faster QE tapering and greater willingness to raise rates has already been priced in during previous weeks. But at the same time, long-term investors should not lose sight of the natural tightening of financial conditions because of these moves, which will slowly but persistently reduce demand for risky assets.

The main risk for the crypto market is that we have seen a monetary regime switch in the last couple of months, which promises to take some of the demand for crypto away.

The FxPro Analyst Team