Market picture

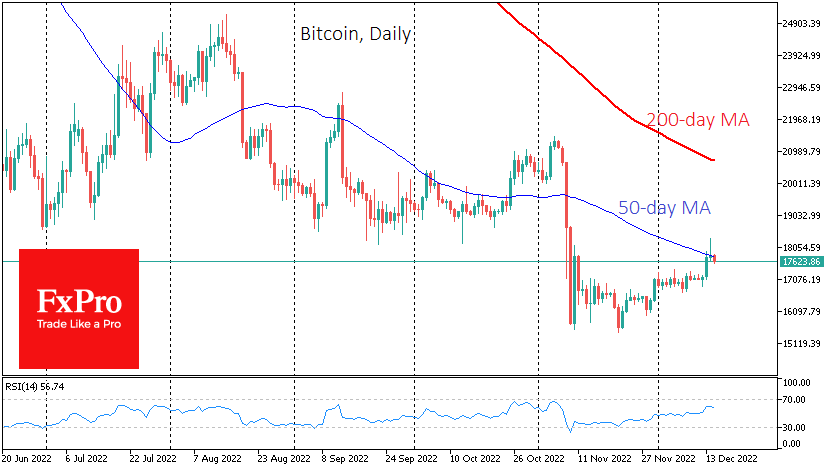

Bitcoin updated five-week highs above $18,300 on Wednesday but then fell along with stock indices amid the Fed’s intention to raise rates higher and hold them longer than markets had hoped.

The market reaction to the Fed brought the price back to levels before the lift-off but did not trigger a sustained decline yet. Bitcoin failed to close the day above its 50-day moving average but continues to hover around that curve. A consolidation above this line could spur additional demand.

The cryptocurrency Fear and Greed Index was up 1 point to 31 by Thursday and continues to be in a state of “fear”. Despite dropping 1.4% overnight, the crypto market’s total capitalisation at 860bn has been near the upper end of its trading range for more than a month.

News background

According to CoinGesco, the number of cryptocurrencies in the BTC and Ethereum networks reached historic highs following the collapse of FTX. The growth rate of large asset holders has quadrupled compared to the annual average.

Goldman Sachs said gold is a better asset diversifier than BTC as it is less volatile.

According to Nansen, about $3 billion has been withdrawn from Binance in the last two days, with user activity attributed to a “temporary suspension” of withdrawals in USDC.

In response to the recent media attack, Tether, the issuer of USDT, said it would reduce the collateralised credits in USDT reserves to zero over the next year.

There is yet to be a consensus among US regulators on cryptocurrencies. The Commodity Futures Trading Commission (CFTC) has called bitcoin, Ethereum and USDT commodities in a lawsuit against FTX CEO Sam Bankman-Fried, who faces up to 115 years in prison.

The FxPro Analyst Team