Bitcoin has surpassed the $23170 mark, adding more than 9% in the past 24 hours. Ethereum jumped 13% to $1640. Other leading altcoins in the top 10 have gained between 6% (BNB) and 15% (Polkadot).

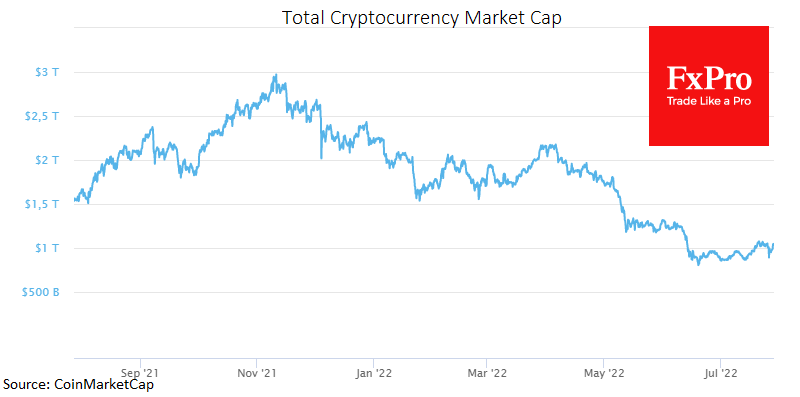

The total capitalisation of the crypto market, according to CoinMarketCap, rose 8.9% overnight to $1.06 trillion.

Bitcoin buying picked up sharply on Wednesday following the Fed’s decision and subsequent comments. The crypto market has once again proved that it is growing stronger than equities regarding restoring demand for risky assets. While policy tightening is a negative for asset valuation, it was already priced in, and the subsequent relatively neutral signals from Chairman Powell added strength to new buying in equities and cryptocurrencies.

Technically, BTCUSD has moved back above its 50-day moving average in a strong move and continues to rise as of Thursday morning. We will draw attention to the $24K area, where earlier in July, growth momentum stalled. The ability to gain further strength could increase the confidence of the market participants that the bottom is behind us.

The International Monetary Fund (IMF) released a report on the global economy, noting that the fall in the cryptocurrency market has not affected the global financial system’s stability. The IMF suggests that the crypto market will undergo a painful transformation, with a string of bankruptcies of cryptocurrency companies continuing.

Katie Wood’s ARK Invest fund sold $75m worth of Coinbase shares because of an SEC investigation. The regulator accuses some former top Coinbase executives of insider trading.

According to media reports, the US Treasury suspects cryptocurrency exchange Kraken is violating sanctions against Iran.

The US Consumer Financial Protection Bureau (CFPB) will investigate the use of digital currencies for payments and increase oversight of technology companies as they enter the traditional financial sector.

Tether, the issuer of USDT, the biggest by capitalisation stablecoin, has promised to zero in on commercial paper reserves from the current $3.7bn no later than November and clarified that they do not hold Chinese securities.

The FxPro Analyst Team