Market picture

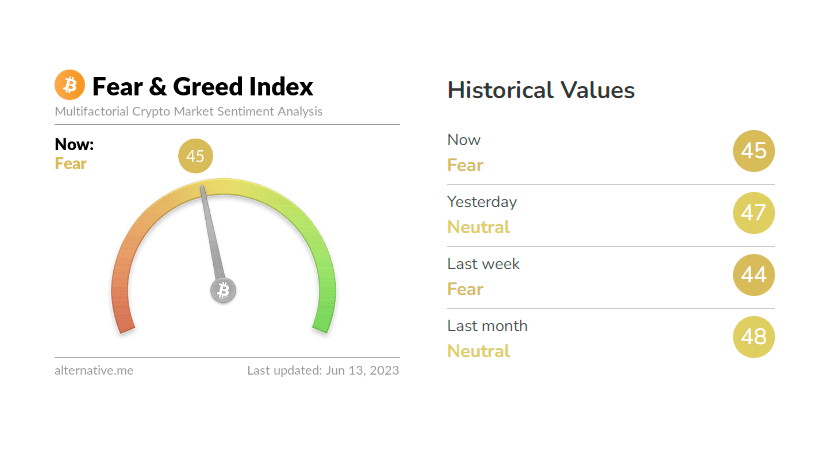

The crypto market cap rose 1% in 24 hours to $1.06 trillion. Bitcoin adds 1%, while Ethereum just 0.4%. Meanwhile, the top altcoins try to recover some losses, adding between 0.2% (Cardano) and 4% (BNB). The cryptocurrency Fear & Greed Index is in the Fear territory at 45 (-2 points overnight), whereas the Fear & Greed index for the stock market is at 79 (extreme greed).

Bitcoin is struggling for a third day to hold above $26K. This struggle away from meaningful technical levels shows how heavy the crypto market is right now, despite optimism in equities and a slightly decreased USD rate. Technically, to break the downtrend, Bitcoin needs to overcome $27K, and a drop below $26.5K is required to confirm the downtrend. The second scenario seems more likely.

According to CoinShares, investments in crypto funds fell by $88 million last week, the most in three months and the eighth consecutive week of outflows. Bitcoin fell by $52 million and Ethereum by $36 million.

According to Glassnode, outflows from Coinbase and Binance reached $4 billion during the week. Crypto traders, spooked by SEC lawsuits, are withdrawing assets from exchanges en masse.

News background

According to CryptoQuant, bitcoin reserves on US crypto exchanges have fallen below the 50% – levels last seen in 2017. Assets are flowing to overseas exchanges due to regulatory uncertainty and recent SEC actions against Binance and Coinbase.

Binance’s share of the cryptocurrency market has fallen to 43%, according to analyst firm CCData. Trading volume in the crypto market fell 15.7% m/m in May.

Polygon developers defended their MATIC cryptocurrency, disagreeing with the SEC’s characterisation of it as an unregistered security. The Solana Foundation also criticised the SEC’s decision. Robinhood had previously announced its intention to delist MATIC, ADA, and SOL.

North Korean hackers have stolen $3 billion in cryptocurrency over the past five years to fund the country’s nuclear programme, the Wall Street Journal reported.

The FxPro Analyst Team