Market picture

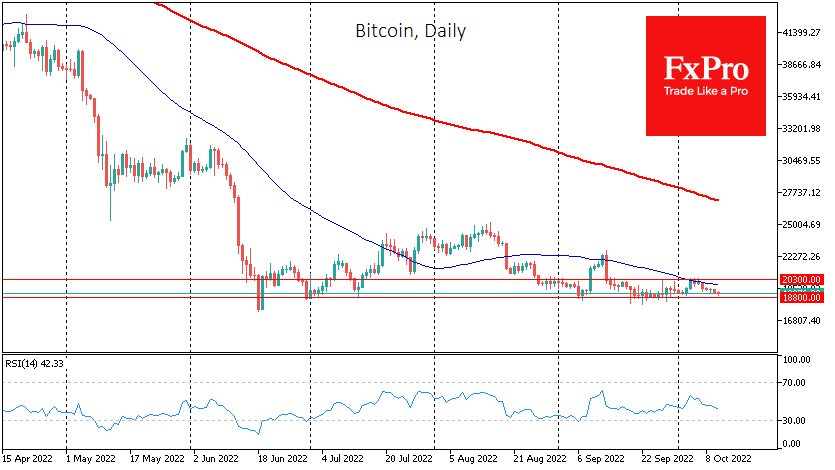

Bitcoin is losing 1.9% over the past 24 hours, falling back to $19K amid falling stock indices and a stronger US dollar. BTCUSD has rolled back to last Monday’s lows and is testing the lower end of the trading range, where there were many upward reversals during the latest four months.

In theory, the bears have a better chance this time, as the cryptocurrency market has undergone a prolonged consolidation, ceasing to be locally oversold. That said, the Nasdaq index had updated more than two-year lows overnight, which could further demoralise crypto bargain hunters.

According to CoinShares, investments in crypto funds declined last week after three weeks of small inflows. Outflows amounted to $5M. Bitcoin investments rose by $12M. Investments in funds allowing shorts on bitcoin fell by a record $15M. Trading volumes remain historically low; investors are waiting for signals that the Fed is ready to review hawkish monetary policy, CoinShares noted.

News background

After another recalculation, the first cryptocurrency’s mining difficulty has set a new high at 35.61T. The increase of 13.55% at once was the largest since May 2021. According to Glassnode, the network’s hash rate (smoothed by the 7-day moving average) is near the record high of 257.9 EH/s recorded on October 6.

According to Santiment, crypto whales have boosted their investment in the first cryptocurrency by 46,200 BTC in the past two weeks.

Billionaire and Tudor Investment hedge fund founder Paul Tudor Jones said he continues to hold investments in the first cryptocurrency because of Fed policies.

The FxPro Analyst Team