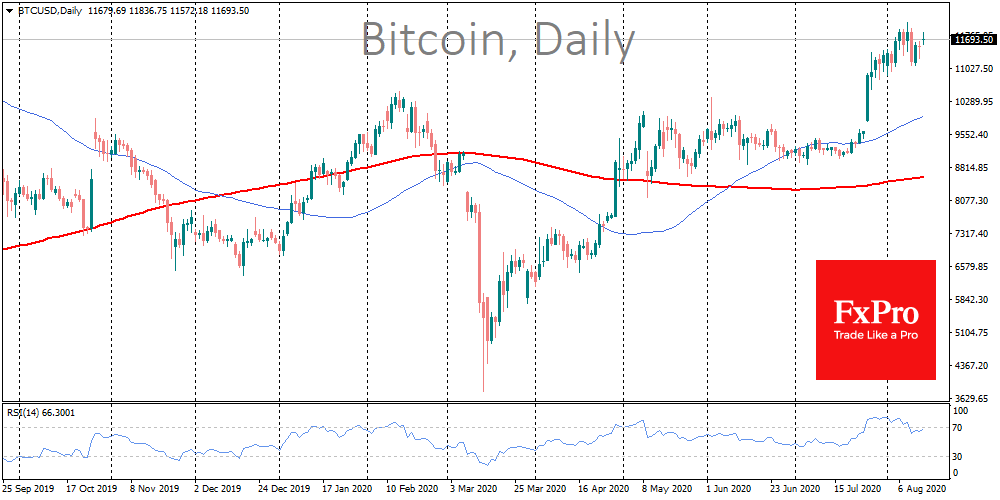

After a short pause, the first cryptocurrency has returned to growth. Although Bitcoin is not leading in terms of growth rate, still the positive dynamics it creates a favourable environment for most altcoins. Bitcoin adds about 2% over the last 24 hours and changes hands near $11,800. Recently, BTC touched $12K, so for participants to confirm the bullish bias, it is now essential to see a rise above this level.

Bitcoin is an asset that must continuously grow to “keep the traction” of the rest of the cryptomarket. The traditional stock market has adopted this tactic from Bitcoin. As a result, the famous “Buffett indicator” (total US stock market to GDP) gives a warning. This indicator once worked back before the collapse of the dotcoms. When this ratio is above 100%, there is reason to believe that the market is overheated.

It is hard to say how one can find a substitute for GDP for cryptocurrencies. Market participants here are likely to be satisfied with reports of technical updates or partnerships. For example, the announcement from TRON and Waves on the unification of their ecosystems led Waves to jump 42%, while Tron grew by 16%.

A stunning recent success story is the Chainlink (LINK), which not only storms into the TOP 10 cryptocurrencies but has already passed one of the most highly capitalised bitcoin forks – Bitcoin Cash (BCH) – in 5th place. The impressive growth started at the end of July and led 150% price increase until now. The coin is riding the wave of DeFi popularity and the heightened need to interact smart contracts with external systems, including banking.

However, cryptocurrencies are getting the main impulse along with the traditional financial system, as well as due to the growing demand from institutional investors. A few days ago, the open interest in bitcoin futures on CME jumped to $841 mln. The Nasdaq MicroStrategy announced the purchase of 21,000 bitcoins. It is still difficult to say where this will lead the crypto market and bitcoins. However, it is safe to say that without institutional money, the crypto market won’t be able to get out of the winter stage.

The FxPro Analyst Team