Bitcoin slowed down on Wednesday after two days of active strengthening, and on Thursday morning, it rolled back to 43.1K, losing 2.2% in the last 24 hours. Ethereum is down 3.3% 0.6% in the same period. Leading altcoins from the top ten lose from 1% (Terra, XRP) to more than 5% (Avalanche).

The total capitalization of the crypto market, according to CoinMarketCap, decreased by 2.5% to $1.09 trillion. The Bitcoin Dominance Index is hovering around 43.1%. The Cryptocurrency Fear and Greed Index fell 13 points to 29, once again ending up in the fear zone.

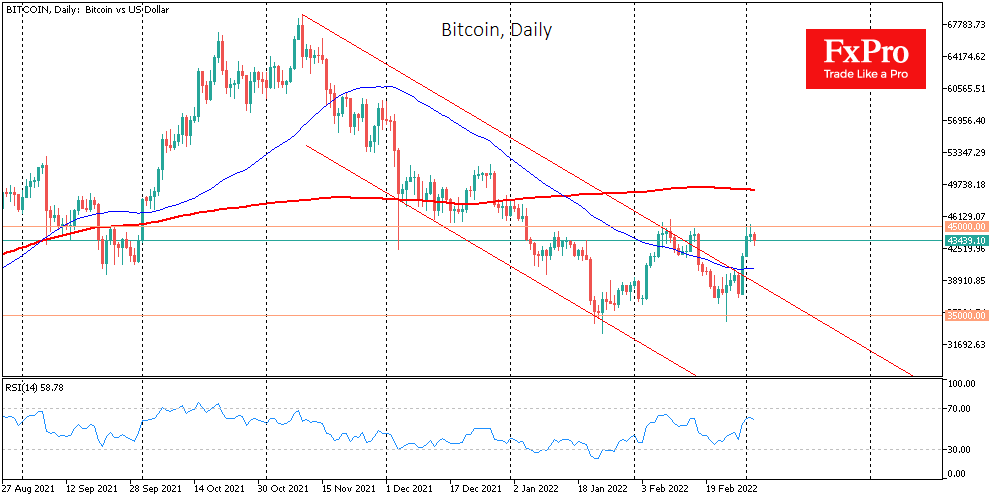

From the technical analysis perspective, Bitcoin slowed down ahead of strong mid-February resistance at $45,000, which then turned the move down. The first cryptocurrency in recent days has not paid too much attention to stock indices, which rose on Wednesday. The technical picture continues to point to a break in the downtrend, although to confirm the reversal, the rate must first fix above 45K.

In the EU, it was previously discussed that since Bitcoin and Ethereum use the Proof-of-Work consensus mechanism, which consumes a lot of electricity and has a negative impact on the environment, it’s time to ban the mining of these cryptocurrencies. However, it was decided to abandon this idea following the new version of the bill on digital assets.

The FxPro Analyst Team