Market picture

Cryptocurrency market capitalisation fell 0.2% over the past 24 hours, losing ground since the start of the day on Wednesday but remaining within the range of $1.16-1.20 trillion since last Thursday. The market remains in a “Greed” mood, according to the Fear and Greed Index.

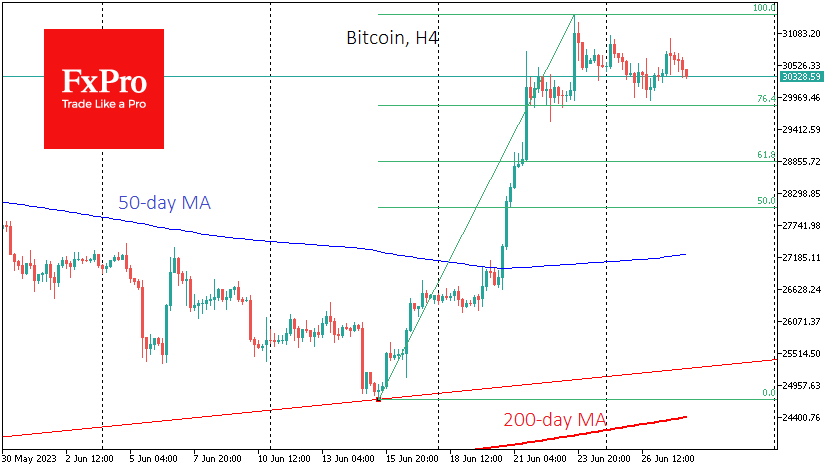

Bitcoin has been squeezed in the $30.0-30.8K range, above a similar consolidation in April, and has settled into an overall uptrend. The shorter-term picture, however, suggests potential correction exists, with short-term targets in the $29.8K area (76.4% of the rally since mid-June), but a pullback to $28.9K (61.8%) is more likely. This should not put the bullish trend in question but will fuel further buying.

Ethereum is trading in a corridor with a slight bearish bias, correcting 4% from its 22 June high to $1860. The development of a corrective pullback here sets the stage for a decline to the $1800-1810 area. A critical round level and the 61.8% line from the last rally to the 50-day moving average are concentrated here.

News background

Miners are selling their accumulated Bitcoin reserves. According to Glassnode’s calculations, BTC miners sent exchanges $128 million worth of cryptocurrency. This figure represents 315% of their daily production, a record.

The average income of a standard airdrop hunter was $9384 per address (median was $6497). According to a joint study by X-explore and crypto journalist Colin Wu, the premium segment had figures of $18,935 and $14,288.

According to The Block’s sources, Fidelity Investments is preparing to file a spot bitcoin ETF. Management companies BlackRock, WisdomTree, Invesco and Valkyrie filed to launch a spot bitcoin ETF in June.

The eight largest financial institutions in the US are “actively working” to provide clients with access to Bitcoin and other cryptocurrencies. Their assets under management total $27 trillion, CoinShares estimates.

The FxPro Analyst Team