Market picture

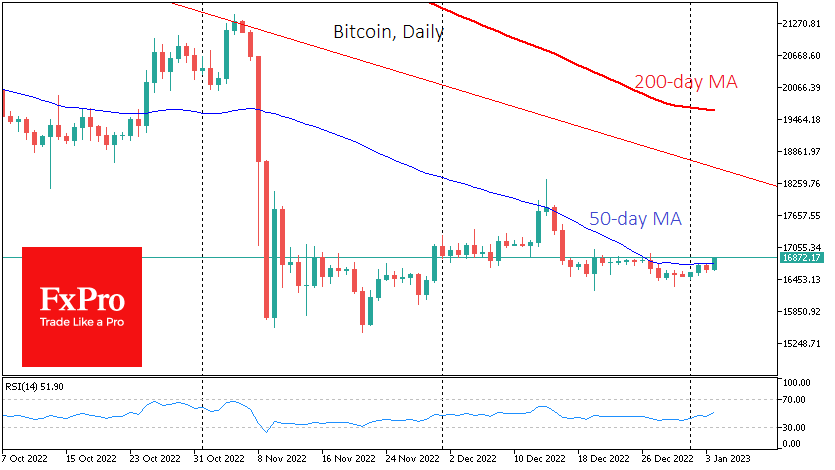

Bitcoin lost 0.5% on Tuesday but started Wednesday with a substantial gain, adding more than 1.3% to $16.8K. The current levels are one-week highs and send the price to the area above the 50-day moving average.

These are new signs that the prolonged sideways slide is ending, and one should be prepared for higher volatility, and this time it may be the altcoins that come to life first, not the first cryptocurrency.

Ethereum is adding over 3.5% since the start of the day, making a solid move above its 50-day moving average and testing the highs of the last three weeks. Here we see a large amplitude of gains, which increases the chances of a break of the downtrend. At the same time, traders with a more distant outlook would prefer to wait for confirmation in the form of a rewrite of the previous highs near $1350.

News background

Crypto-asset monitoring service PricePrediction predicted the bitcoin exchange rate in a month at $15,532, which is about 7% lower than the current value of BTC.

Last year was more of an ice age than a crypto winter, said Circle’s head of strategic development Dante Disparte. However, he is optimistic: bankruptcies and industry clean-up could be a boon for the crypto market in the long run.

Despite the bear market, the level of fraud and hacks in the cryptocurrency industry will not diminish in the new year, according to CertiK, a blockchain security-focused analyst firm. Fraudulent schemes and techniques have been worked out, and the market is vulnerable.

Fourteen years ago, on January 3, 2009, a person (or group of people) under the alias Satoshi Nakamoto launched the leading bitcoin network by mining a genesis block of 50 BTC. The first transaction occurred on 12 January 2009 – Satoshi Nakamoto sent 10 BTC to Hal Finney.

The FxPro Analyst Team