Market Overview

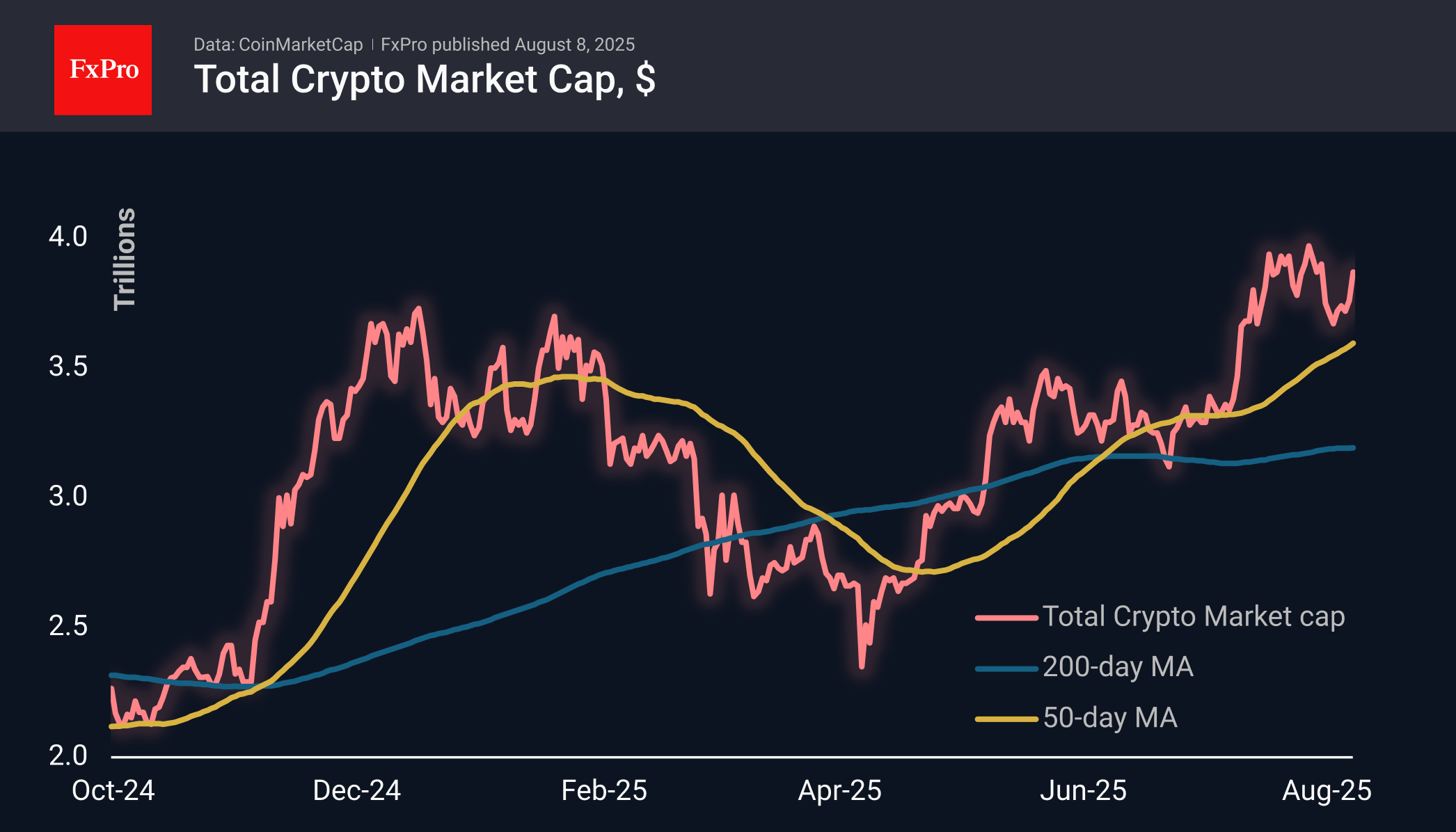

The crypto market climbed out of the hole it had fallen into at the beginning of August. Capitalisation grew by more than 3%, approaching a total market valuation of $3.90 on Friday. This time, XRP leapt upwards, while Ethereum continued to gain weight.

The cryptocurrency sentiment index gained 12 points in one day to 74, which is close to the extreme greed zone. The market was buoyed by the end of the Ripple and SEC case and the approval of cryptocurrency investments in pension plans.

Bitcoin rose at the start of Friday to $117.5k from a low of $114.2k, but overall, it does not look enthusiastic and ready for a breakthrough, despite the huge potential opened by the possibility of pension funds and ETFS investing in the first cryptocurrency. Testing the upper limit at $120k does not appear to be the immediate target.

Ethereum has exceeded $3900 and is trading at its highest levels since December last year. However, this area — $3900–$4000 — has proven to be a turning point so many times that it makes one more sceptical about an imminent breakthrough. But it would be too hasty to rule out a short squeeze, with the price slipping to $4,800 on the liquidation of short sales.

News Background

According to Standard Chartered, public companies with Ethereum reserves are more attractive to investors than spot ETH ETFs. Unlike ETFs, companies can receive rewards for staking (~3% per annum) and use DeFi tools, which increases the overall return on investment.

Fundstrat founder Tom Lee said Ethereum is attracting increasing interest from major US financial companies with offices on Wall Street. He predicts that this altcoin will experience explosive growth, as many stablecoins are being created on the ETH blockchain and large financial companies are taking asset tokenisation more seriously.

According to Bitwise, SEC Chairman Paul Atkins called blockchain the foundation of the future financial infrastructure. This opens unique opportunities for crypto market participants. First-tier blockchains such as Ethereum, Solana, Avalanche, and Cardano will benefit from the regulator’s new strategy.

Trump’s new tariffs on mining equipment imports from Southeast Asia have hit Bitcoin miners in the United States. Luxor Technology warns that this could slow the industry’s growth in the US.

The FxPro Analyst Team