Market picture

The cryptocurrency market remained in the same position as the day before, with a capitalisation of $2.09 trillion (+0.07% in 24 hours). Bitcoin’s price stabilised after the crash, with Solana losing 3% and Ethereum recovering 2% over the same period.

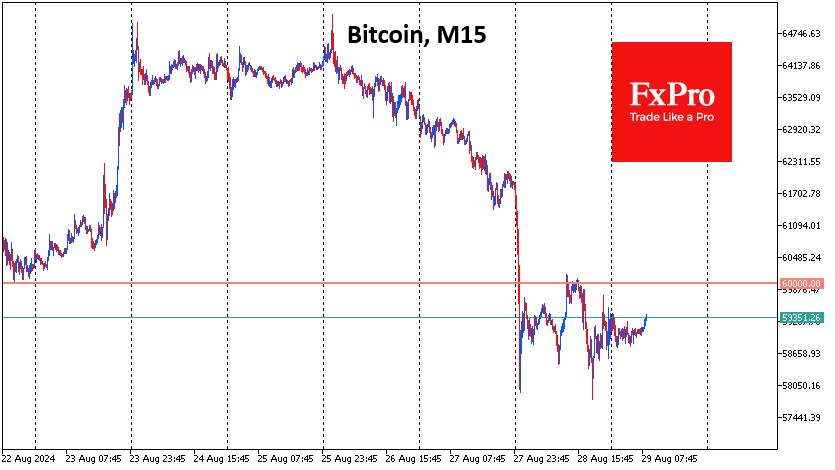

Bitcoin buyers beat back several waves of selling on Wednesday, preventing the price from consolidating below $58K. This dynamic increases the chances of a rebound during the day on Thursday. A rise above $60K will allow us to talk about a more significant growth than just a technical rebound.

In the absence of a meaningful cryptocurrency rally, which is often the case in a half year, bitcoin has been consolidating its dominance, reinforced by the launch of ETFs at the start of the year. However, this story doesn’t apply to Ethereum, whose crypto market share has shrunk to 14.6% from 18.8% a year earlier. The ‘other’ category lost roughly the same market share over the course of the year but has been trending upward for the past month. Ethereum is in danger of fading into the sunset, as is Litecoin, whose capitalisation is now close to the cyclical market lows of two years ago.

News background

Experts believe that the collapse of TON due to the arrest of Telegram founder Pavel Durov could have been a catalyst for the deterioration of sentiment in the crypto market. The situation may have been exacerbated by technical problems with the blockchain caused by the crash. The network overload was caused by ‘garbage’ operations with the DOGS meme token.

Glassnode warned that Bitcoin’s relative calm last week will be replaced by a period of increased volatility. Both on-chain indicators and perpetual contracts have reached equilibrium. Such signs indicate a reduction in speculation and usually precede a significant increase in volatility.

CoinGecko notes that the political coin category (PolitiFi) has significantly outperformed the entire meme coin segment in terms of capitalisation growth in 2024 – 782.4% vs. 90.2%. Most of these assets are satirical and not officially linked to any politician.

Telegram founder Pavel Durov was released on €5 million bail on Wednesday and is banned from leaving the country. Durov is charged with six offences for which he faces up to 10 years in prison. In recent days, prosecutors in Germany and India have also announced investigations into Telegram and its founder for a similar range of offences.

The FxPro Analyst Team