Market picture

The cryptocurrency market is hitting new highs, bringing its capitalisation to $2.58 trillion (+2.4% in 24 hours). But today, bitcoin is one of the market’s laggards, up 1.2%, as growth is concentrated in the largest altcoins.

Ethereum is up 5% in 24 hours, and BNB went up as much as 9%, about the same as Dogecoin. Cardano is up a modest 0.45%. Sentiment remains in extreme greed territory.

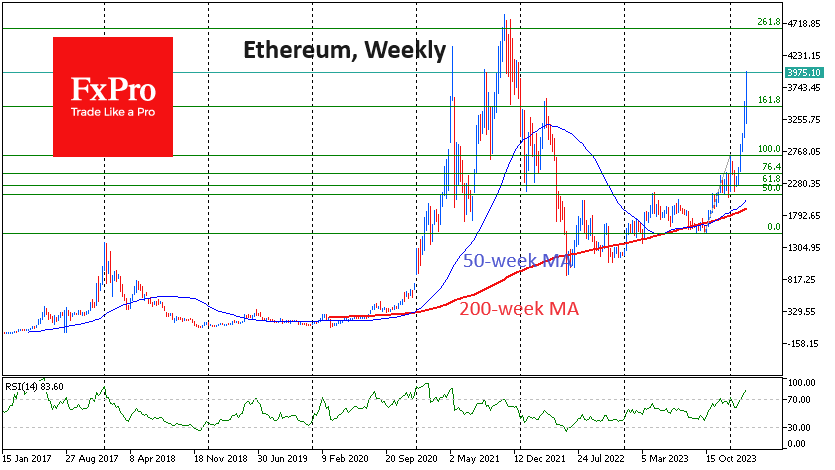

Ethereum is approaching the $4000 level, confidently making the second-largest contribution to market cap gains after Bitcoin. A similar overbought condition in Ethereum on a weekly timeframe was not seen until 2021. Given that this is the first such overbought condition after a prolonged bear market, be prepared for the move to continue. It’s hard to see any significant resistance until $4100. However, like BTC, ETH is well positioned to test the highs of $4700 without significant corrections.

News background

BlackRock’s Bitcoin ETF set a record for daily inflows of $788.3 million, while trading volume also reached a record $3.76 billion.

According to SoSovalue, the total trading volume of spot bitcoin ETFs in the US exceeded $10.4 billion, surpassing that of Microsoft shares ($8.9 billion). Total assets under management reached $53.11 billion, with BlackRock’s IBIT and Fidelity’s FBTC among the top 20 most actively traded ETFs.

The Arizona Senate is considering a proposal to allow cash bitcoin ETF shares to be added to state pension funds.

Bitcoin (BTC) volatility has reached its highest level since the collapse of the FTX exchange in November 2022, according to data compiled by Bloomberg.

BlockFi, a lending platform undergoing bankruptcy proceedings, has reached an agreement in principle to settle claims against FTX and Alameda for $874.5 million. The funds will be used to repay customers of the service.

Meme coins of celebrities with misspellings, such as Jeo Boden, Danold Tromp and Olen Mosk, caused a buying frenzy among Solana users. Interest in the segment came after improving market sentiment, which, in general, contributed to triple-digit price increases in a week for DOGE, SHIB, BONK, PEPE, and WIF.

The FxPro Analyst Team