Market picture

Another attempt by Bitcoin to break above $28K triggered a wave of selling that took the price back to $27.2K at the peak of the decline. Interestingly, the pressure on Bitcoin came when the risk appetite in traditional markets was recovering. We attribute this to Monday’s US defaulted debt markets rather than the moving of money from one asset to another.

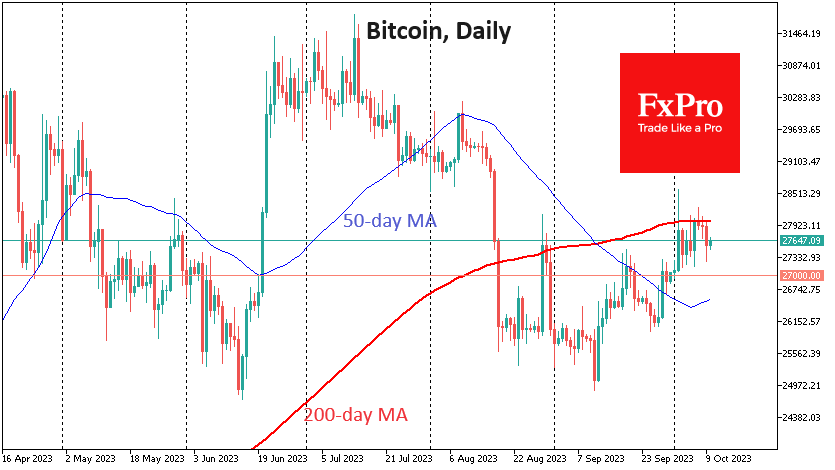

Technically, bitcoin has established $28K as a severe resistance level but is not yet on a clear downward path.

Ethereum remains weaker than the market, having pulled back below $1580 on Monday evening – the bottom of the last two months’ range. So far, the situation looks more like a smooth downtrend with a possible pause near significant support. But without a confident reversal from current levels, we can’t talk about stopping the decline.

News background

According to CoinShares, investments in crypto funds increased by $78 million last week, continuing the inflow for the second week. Bitcoin investments increased by $43 million, and Ethereum investments increased by $10 million. Solana saw its largest weekly influx since March 2022 at $24 million, continuing to establish itself as the altcoin of choice.

Last week was an essential test for Ethereum investors following the launch of six futures ETFs in the US. They raised just under $10 million in their first week, in sharp contrast to a similar bitcoin ETF that raised $1 billion in October, according to CoinShares.

Most investments in cryptocurrencies will be devalued entirely, said Charles Munger, vice chairman of Berkshire Hathaway and an associate of Warren Buffett.

The UK’s Financial Conduct Authority (FCA) has drawn up a blocklist of 143 cryptocurrency companies with which it is not advisable to do business. The list includes popular crypto exchanges HTX and KuCoin.

The Solana development team announced the rollout of the 1.16 update to the network, significantly reducing the RAM requirements of validator hardware and allowing for confidential transactions.

Binance exchange CEO Changpeng Zhao ruled out an explosive rise in bitcoin immediately after the halving. According to him, BTC usually does not reach new highs until a year after the miners’ reward is cut.

The FxPro Analyst Team