Market Picture

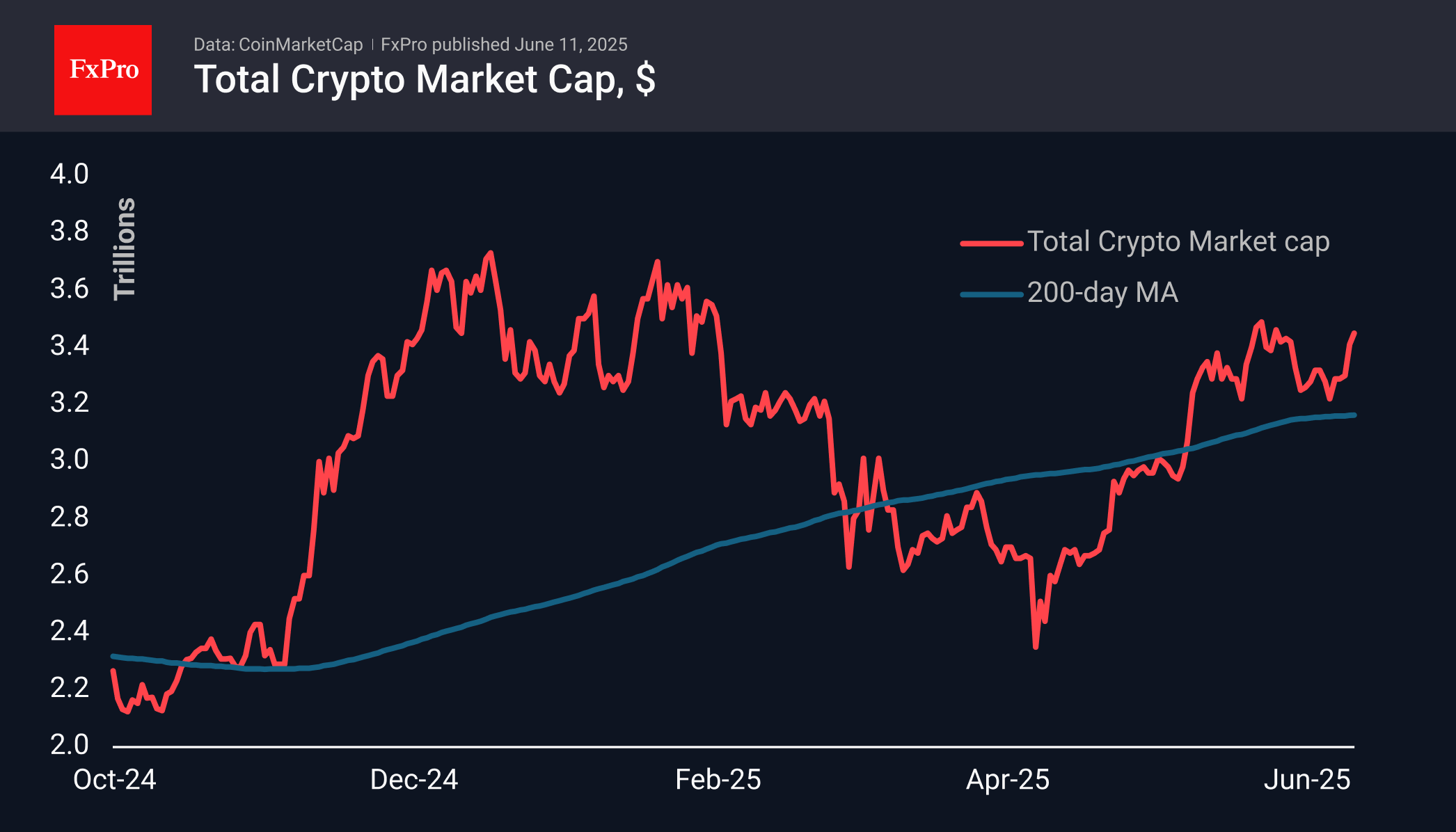

Market capitalisation grew by 0.6% in 24 hours, adding almost 4% in a week to $3.45 trillion. The market consolidated near these values a couple of weeks ago. Such a step-by-step climb is quite familiar. The likely continuation of positive sentiment allows us to consider the area of historical highs around $3.7 trillion as the next stop. The abundance of money from institutional and professional traders has dramatically suppressed FOMO impulses, so the type of market growth now looks more like a climb with frequent breaks than a rocket launch. Although less intense, this type of growth is more suitable for long-term portfolios.

Bitcoin is trading above $109K, experiencing increased selling pressure on growth above $110K. This pressure may become even more intense as it approaches $112K, the area of the historical high set at the end of May. Breaking through this level will make $135K the technical target.

Ethereum has picked up momentum, adding nearly 5% in 24 hours to $2,800. It has recovered losses since the end of February and is consolidating above the 200-day moving average. If Ethereum’s dynamics are an indicator of altcoin sentiment, then we will see increased readiness for the altcoin season.

News Background

BlackRock’s largest Bitcoin ETF (IBIT) has become the fastest-growing exchange-traded fund in history. IBIT’s assets exceeded $70 billion in 341 trading days, while GLD took 1,691 days to do so.

Strategy additionally purchased 1,045 BTC ($110.2 million) last week at an average price of $105,426 per coin. The company now owns 582,000 BTC, purchased at an average price of $70,086. The total investment is estimated at $40.2 billion.

The Coinbase premium (the difference between prices on the largest American crypto exchange and other platforms) has reached a four-month high, indicating support from American buyers, according to CryptoQuant.

According to BaykusCharts, the supply of digital gold on exchanges has decreased by ~35%, from 1.55 million BTC to 1.01 million BTC, since July 2024.

US SEC Chairman Paul Atkins announced the agency’s new approach to non-custodial storage of cryptocurrencies. The agency is also working on measures to exempt De-Fi platforms from regulatory barriers.

The FxPro Analyst Team