Market picture

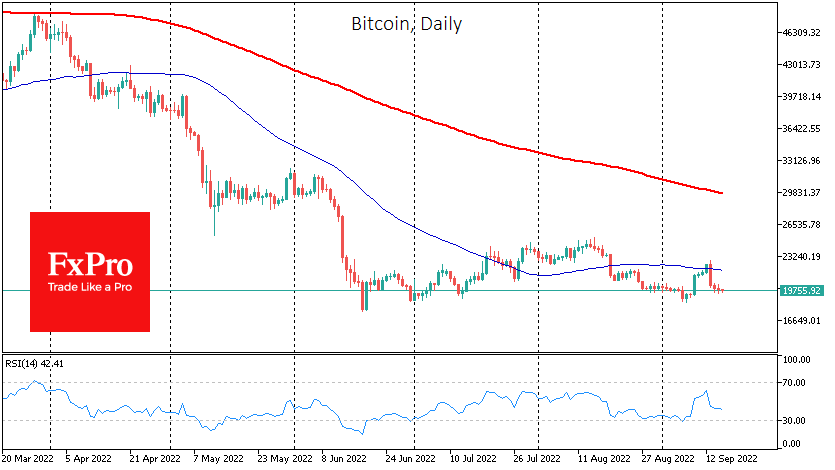

Bitcoin has lost 1.6% over the last 24 hours to $19,777 amid renewed pressure on risk-sensitive assets. BTC remains just under the critical $20K round level, where it got support for the past three months.

Ethereum lost the speculative support it received before the move to PoS. Over the last day, Ether lost 8.6%, more than three times more than the 2.6% reduction in overall crypto capitalisation. Weakness of this kind is an almost inevitable consequence of a previous period of overperformance, much of the gains of which have yet to be erased. Trading at $1500, Ether is now almost 50% above the area of the June-July lows, while Bitcoin has rolled back to its lows of that period.

News background

Tether and Bitfinex technical director Paolo Ardoino said the move to PoS will not help the second cryptocurrency catch up to Bitcoin. The Merge will not lower transaction fees or make ETH more decentralised, nor will it increase network capacity. Ethereum cannot compete with BTC as a form of money because it has no maximum issue limit.

According to Santiment, more than 45% of Ethereum nodes launched after The Merge update are managed by just two addresses, raising concerns crypto community concerns about centralisation.

According to Chainalysis, developing countries are leading the world in cryptocurrency adoption. Vietnam and the Philippines lead the rankings due to the popularity of cryptocurrency and NFT gaming projects. Of the developed countries, only the US and China are in the top 10, ranking fifth and 10th, respectively.

The FxPro Analyst Team