Market Picture

The cryptocurrency’s market capitalisation rose 4.3% in the last 24 hours, hitting $1.29 trillion. Ether’s rally is successfully pulling most of the market with it.

Bitcoin is up 2.4% overnight, underperforming the market but revisiting last June’s highs near $30.8K.

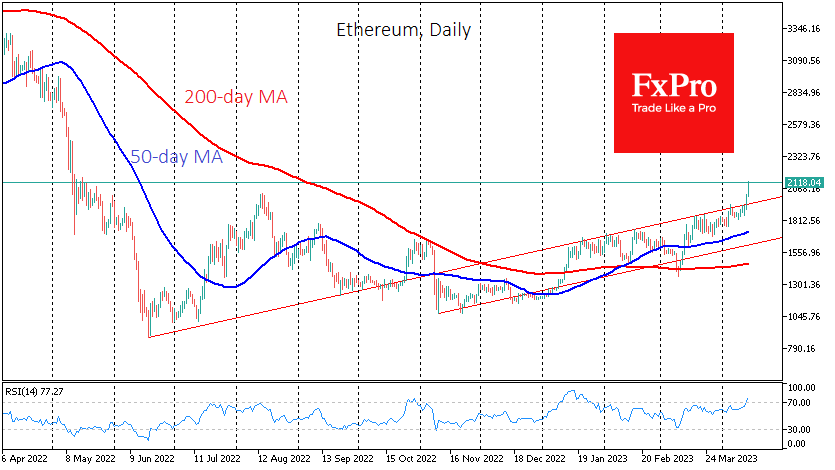

Ethereum is up more than 10% overnight, trading above $2100. This is its highest level since last May. The successful activation of the Shapella hard fork triggered the rally. The update was activated on the night of the 12th at 22:30 GMT, allowing withdrawal from the stacking. Contrary to fears, this did not pressure the ETH exchange rate but accelerated the upward trend in December.

According to Nansen, complete withdrawals are available for 7,948 validators with a total of 284,622 ETH (more than $546 million) in their balances. The total assets in the stack exceed 18 million ETH. However, 56% of the validators’ addresses need the 0x01 prefix required to unlock assets.

News background

Attorney John Deaton, who defends the interests of XRP cryptocurrency owners, believes that after the Ethereum network switches to the PoS consensus algorithm, officials may recognise ETH as security.

Web3 attorney Jess Hynes said that the SEC would continue to tighten regulation of cryptocurrencies in the US. In his opinion, such measures are still necessary to protect investors.

Warren Buffett, the famous investor and head of Berkshire Hathaway, once again criticised Bitcoin, calling it an asset with no intrinsic value and suitable for gamblers.

The FxPro Analyst Team