Market picture

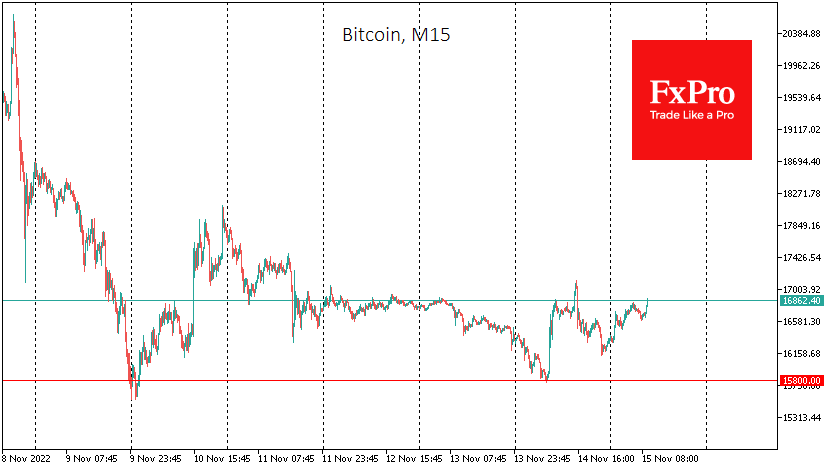

Bitcoin is trading in the $16.7K area (+1.6% in 24 hours), a significant consolidation area of the past five days. It was helped back to these levels by the news of Binance launching a fund to help cryptocurrency companies experiencing temporary liquidity difficulties. The news has stopped a wave of selloffs but has yet to be able to turn the market up.

On the intraday charts of BTCUSD, there is a notable resistance area near the current price. In Ethereum, the situation is very similar, and the price fails to develop a growth above $1250 (+2.2% in 24 hours). The two most popular cryptocurrencies have the widest share of institutional investors, whose confidence in the sector has been eroded recently. It is their professional unloading into the market that we are now seeing on the charts.

The entire crypto market is more enthusiastic, adding 4.3% in capitalisation overnight to $841B, according to CoinMarketCap estimates.

According to CoinShares, investments in cryptocurrencies rose last week to their highest in three months. Inflows of $42M compared to outflows of $16M a week earlier. Bitcoin investments rose by $19M, and Ethereum by $3M. Investments in funds that allow shorts on bitcoin increased by $13M. Altcoin basket products attracted the highest since June by $8M. Investors saw the FTX collapse as an investment opportunity, CoinShares noted.

According to Glassnode, BTC withdrawals from cryptocurrency exchanges reached an all-time high of 106,000 BTC for the month. Previously, the market has only experienced similar BTC outflows three times in history.

News background

Binance CEO Changpeng Zhao and MicroStrategy founder Michael Saylor urged users to store assets in cold wallets, especially during “market turbulence”. According to Bloomberg, FTX customers are unlikely to get their funds back.

Elon Musk said the crypto winter could be long, but bitcoin would eventually survive.

The collapse of FTX showed that the cryptocurrency industry needs “prudent regulation”, US Treasury Secretary Janet Yellen said. The consequences of the incident could have been much worse if the crypto market had been more connected to the traditional financial system, she said.

The FxPro Analyst Team