Market picture

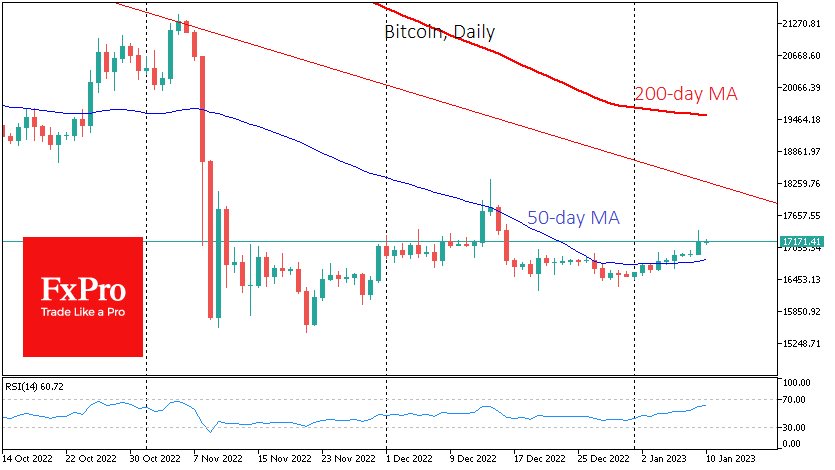

Bitcoin rose to $17350 on Monday but returned to $17200, showing zero momentum over the past 24 hours. The buying was held back by the waning momentum of buying in US equities.

Fed officials continue to press the market, warning that they are ready to raise the rate “markedly above 5%”. Such statements are alarming because they come after labour market data showed increasing economic weakness.

As the source of the pressure on Bitcoin is pressure on equities, the overall capitalisation of the crypto market has not suffered as much, adding 0.3% in the last 24 hours to 850bn – near the highs of the last four weeks.

According to CoinShares, investments in crypto funds declined by $10m last week, with outflows continuing for the third week. Investments in Bitcoin were down $6.5m, and into Ethereum decreased $3m. Investments in funds that allow shorts on bitcoin were up $1m.

From the tech analysis side, the positive scenario remains prevalent as long as Bitcoin trades above 16800, which coincides with the 50-day moving average and the local resistance area at the end of December.

News background

Slightly highlighted is a $3 million influx in XRP, likely due to hopes for a positive outcome of Ripple’s lawsuit against the SEC. However, CoinShares notes that trading volumes remain low, and sentiment in early 2023 is moderately negative.

US authorities are investigating US hedge funds’ ties to cryptocurrency exchange Binance as part of an investigation into possible anti-money laundering violations, The Washington Post reports. According to Reuters, attackers laundered at least $2.35 billion in illicit funds through the exchange between 2017 and 2021.

According to Beosin, damage to the crypto industry in 2022 from 167 major attacks was about $3.6 billion, up 47% from a year earlier. Decentralised finance (DeFi) projects were attacked the most, as security in this sector leaves much to be desired.

The FxPro Analyst Team