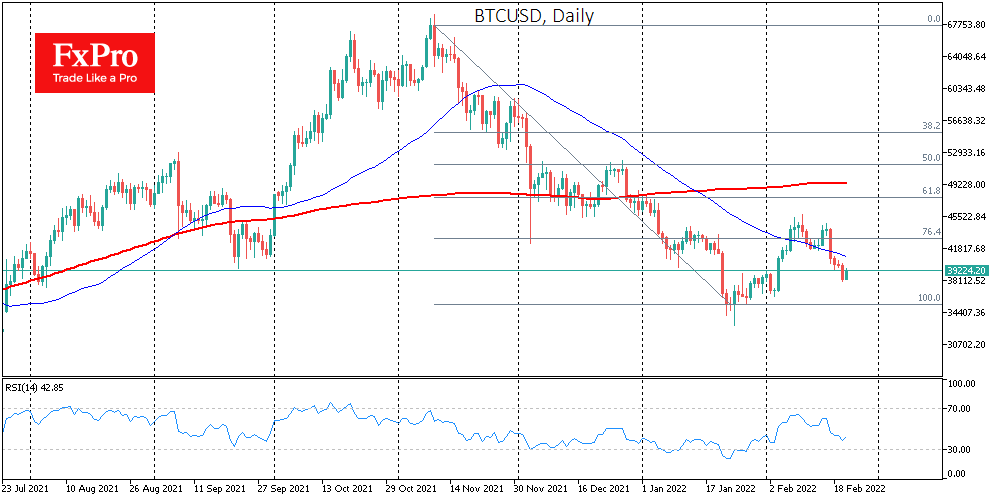

Last week, BTC repeated the dynamics of the first ten days of February. The rate strengthened on Monday-Tuesday, and on Wednesday, it exceeded the level of $44,800. Then on Thursday, the price began to fall sharply in unison with stock indices. The decrease in risky assets was caused by the growing tension around Ukraine, where the situation is becoming tenser.

On Friday, Bitcoin continued to fall, briefly dropping below the round level of $40,000. This mark was broken on Sunday, and BTC tested the next support level at $38,000. The situation is aggravated by the increase in cryptocurrency sales by miners. As a result, the bears may try to push the price to $36,000 and even $33,000.

We must say that bitcoin has lost all the growth of February over the past week. In addition to the upcoming Fed rate hike, BTC has been hit by growing geopolitical risks.

In addition to this, the founder of Ethereum, Vitalik Buterin, noted that he sees early signs of the onset of crypto winter. This spurred crypto sales among retail investors over the weekend. However, ETHUSD is up 5.3% on Monday, recouping Sunday’s decline and continuing to struggle to close the third month in the red.

Overall, Bitcoin was down 9.2% over the past week, ending it at around $38,300. Ethereum lost 9.7%, other leading altcoins from the top ten also sank: from 3.3% (Avalanche) to 11% (Cardano).

The total capitalization of the crypto market fell by 7% in a week, to $1.82 trillion. The Bitcoin dominance index fell 0.7% to 40%, due to less weakening of altcoins. The Bitcoin Fear and Greed Index lost another 2 points to 25 on Monday, returning to the extreme fear territory.

The FxPro Analyst Team